With Stellantis CEO Carlos Tavares set to deliver a keynote address, the Ram brand will stage one of the big announcements at this week’s Consumer Electronics Show, the debut of the Ram Revolution.

It’s a thinly disguised version of the all-electric Ram 1500 pickup set to go into production for 2024. The automaker hasn’t provided many details yet, but the truck is expected to deliver payload and towing numbers in line with Ram’s gas-powered pickups — while also boasting range of as much as 500 miles per charge.

The production version of the Ram 1500 EV will join what is already becoming an increasingly crowded field of all-electric pickups, with models like the Ford F-150 Lightning, GMC Hummer EV and Rivian R1T now on sale. By some estimates, there could be a dozen — or more — midsize and full-size pickups available in the U.S. market by mid-decade from brands as diverse as Tesla to Kia. The question is whether they’ll find a ready market among consumers.

“It’s really too early to tell how traditional pickup buyers will embrace electric models,” said Stephanie Brinley, principal auto analyst with IHS Markit.

The Pros

These days, pickups have a “cool factor” for many owners, added Brinley, but for the majority of buyers, “it’s about getting things done,” and manufacturers like Ford, GM and Stellantis still must prove their all-electric trucks can deliver.

On the positive side, electric motors can deliver plenty of stump-pulling torque. The Lightning, for example, makes up to 580 horsepower and 775 lb-ft with its long-range pack — enough to handle more than 2,000 pounds of payload and 10,000 pounds of trailer. And it’s faster than any existing gas or diesel model, hitting 60 in as little as 4 seconds. The GMC Hummer EV, meanwhile, pushes out 1,000 hp in its Edition 1 trim.

Another plus: while initial purchase prices are higher than for comparable gas models, EV operating costs are substantially lower over the long run. That’s appealing to fleet operators who closely focus on their cost-per-mile numbers.

And the Cons

The latest trucks are minimizing range anxiety concerns — at least under optimal conditions. The Lightning gets as much as 320 miles per charge. The Chevrolet Silverado EV is targeting a peak 400, and the Ram 1500 EV reportedly will deliver as much as 500 miles per charge.

On the downside: range can drop significantly when towing large, aerodynamically inefficient trailers. And range is also adversely affected by cold weather. EVs, in general, can lose as much as 40% of their range when temperatures drop to 20 degrees Fahrenheit or below, according to Consumer Reports’ research.

Early demand exceeds expectations

That said, early numbers are pointing in the right direction for manufacturers entering the EV pickup space. GMC is already sold out of the Hummer model for the 2023 model year, and Rivian is struggling to meet demand for the R1T.

Ford initially tooled up its dedicated Lightning factory in Dearborn, Michigan to produce about 25,000 of the trucks annually. It has had “knock down the walls,” said EV program chief Darren Palmer, and retool for 150,000 trucks, a run rate Ford hopes to reach by the end of 2023, he told TheDetroitBureau.com.

“If you look at the longer term, there’s space for all of these” offerings from the Detroit automakers that traditionally dominate the pickup segment, said Brinley.

A “madhouse” of new models

The Detroit Big Three have already announced products including the GMC Hummer EV, the Ford F-150 Lightning, the Chevrolet Silverado EV, the GMC Sierra EV and the Ram 1500 EV. Ford CEO Jim Farley confirmed that his company will add at least one other electric pickup around mid-decade, with observers debating whether that will mean a version of the midsize Ranger or compact Maverick pickups — or, perhaps, both. And GM and Stellantis would surprise no one if they added electric versions of their midsize pickups, as well.

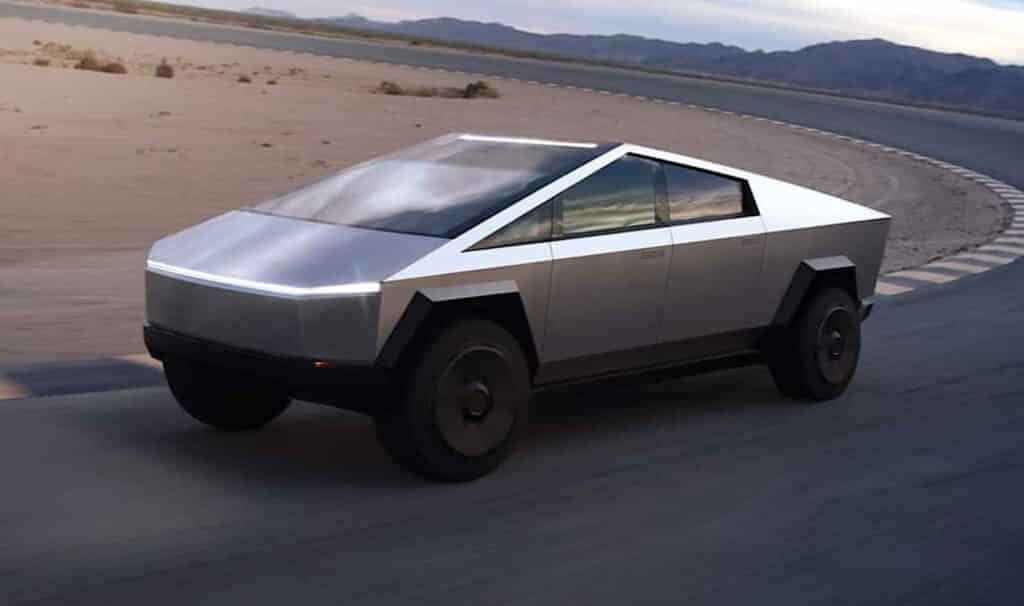

Meanwhile, the EV pickup segment has also seen the launch of the Rivian R1T, as well as the newly introduced Lordstown Endurance. And Tesla CEO Elon Musk has promised to get the long-delayed Cybertruck into the market by the end of this year.

“It’s going to be a madhouse,” Brinley added, “in terms of all the nameplates” to come.

More to come

Toyota CEO Akio Toyoda previously confirmed his company will introduce an electric pickup, though it’s not clear if it will be a mid- or full-size offering. Kia is working on two EV trucks with at least one set to reach U.S. showrooms. Nissan, Hyundai and Volkswagen have also hinted they might get into the market. And so might several other startups. That includes Canoo, though the company has warned investors that it won’t be able to reach production without raising new capital.

All told, Brinley and other analysts anticipate there will be a dozen or more all-electric pickups in U.S. showrooms by the mid to latter part of this decade.

The competition, said Ford’s EV chief Palmer, will be “relentless.”

He’s confident the demand will be there. Ford plans to open the largest manufacturing complex in its history, the 5 square-mile BlueOval City, near Memphis by 2026. It will focus exclusively on EV trucks, including both the second-generation Lightning and at least one other model. As the single most expensive project in Ford’s history, the automaker has to hope that it can convince buyers to make the switch from gas and diesel to battery power.