Tesla intends to invest $776 million to expand the campus of its newest Gigafactory production facility in Austin, Texas.

According to documents filed Monday with the Texas Department of Licensing and Regulation, the money is intended for a “ground up and complete interior finish out of the EV production plant,” with construction set to begin later this month and end early next year.

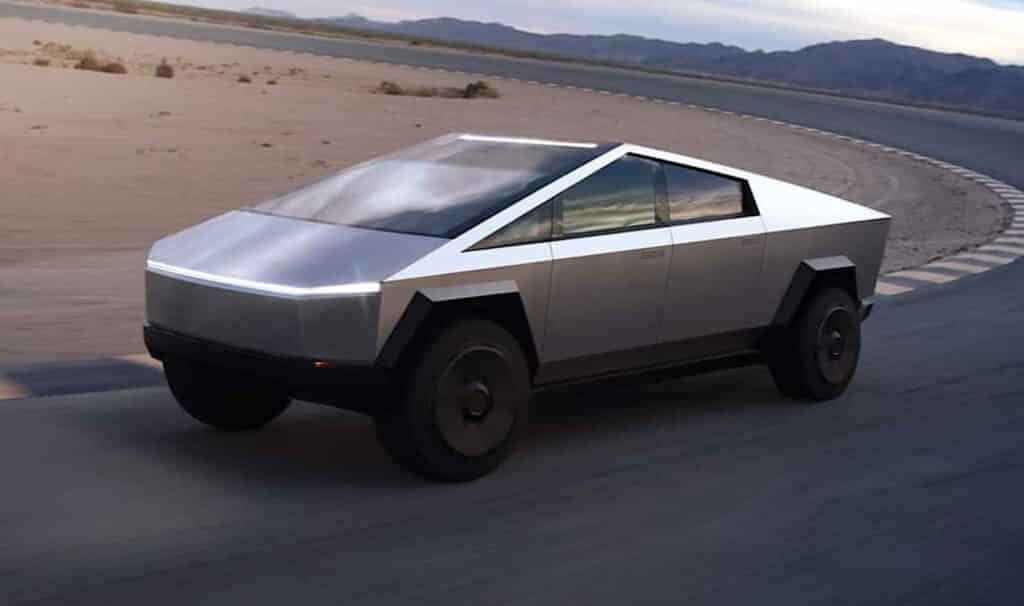

Whether the money is part of the $1 billion Tesla previously stated it has planned to invest in the plant is unclear. Also unclear is whether it signals that Cybertruck production will soon start there. The plant currently builds the Model Y and Tesla Semi.

Tesla’s current manufacturing network comprises Gigafactory assembly plants in Fremont, California; Shanghai, China; Berlin, Germany and Austin, Texas. It also operates a battery plant in Reno, Nevada.

Not the only new plant investment

Tesla’s Austin Gigafactory investment comes as the automaker is closing a deal to build a plant in Indonesia, which would situate Tesla’s newest plant in a nation known for reserves of essential battery materials.

According to Bloomberg News, the new plant could produce as many as 1 million Teslas annually. But more than a mere investment in a new production facility, the automaker would also build additional plants in the country that would facilitate supply chain functions.

Tesla’s Indonesian plant would further cement its investment in that country following its $5 billion agreement with the country to supply the automaker with nickel. But the country has been wooing Tesla as it seeks to be more than a raw material supplier. The cost of the new plant remains unknown.

But the plant would be an odd fit in some regards, as Indonesian cars typically cost less than $20,000. But the location would give Tesla access to the broader Southeast Asian market.

The new plant would be the company’s third outside of the United States.

Other overseas expansion

Tesla’s first plant outside the U.S., Giga Berlin, in Berlin, Germany, saw the its first vehicles roll off the line last March. But by November, reports surfaced suggesting the company wants to expand its German production facility to produce as many as 1 million units a year.

That would equate to a doubling of its production capacity, ramping up from its current production rate of 3,000 cars per week. To meet that goal, the company would have to produce as many as 10,000 EVs per week. The company is currently clearing 173 acres for the factory’s expansion.

But it’s not the only expansion plans for America’s largest EV manufacturer.

But rumors are swirling that the company plans to build a new $1 billion factory near Monterrey, Mexico, following reports of discussions between Tesla CEO Elon Musk and Mexican officials in 2022. The country offers a number of advantages, including low labor costs and close proximity to the U.S. market. Mexico also has more free trade agreements than any other country but Israel. Ultimately reports suggest that Tesla’s Mexican operations will ultimately total $10 billion, nearly double the $5.5 billion investment Tesla made in its new Berlin operation.

But why?

Given Tesla’s latest sales slump, some might wonder why the company is expanding in the face of declining demand.

The automaker dangled $7,500 in incentives to buyers of its two most popular products: the Model 3 sedan and Model Y SUV late last year in an effort to reduce inventory. Tesla initially offered $3,750 incentives before doubling it when demand didn’t meet expectations. The automaker then went further, three months of the Full Self-Driving option for free for buyers of any Tesla delivered in the final three days of 2022.

Its sales shortfall was exacerbated by plummeting sales in China. Tesla extended a 10,000-yuan incentive and cut car prices by 6% to 13.5% on Friday for the second time in less than three months, which could signal a price war. But the cuts weren’t enough to stem the automaker’s December sales from nosediving 21% year-over-year to 56,000 vehicles, and down 44% from the previous month.

But overall, Tesla’s Chinese sales rose nearly 50% for the year, according to figures posted by the China Passenger Car Association. But its recent sales decline comes as Chinese automaker BYD overtook Tesla in China, a market that accounts for 40% of Tesla’s sales. That said, BYD’s dominance doesn’t come strictly from EVs; Tesla’s does.

While slumping demand is a cause for concern, broader issues have to be considered. Tesla’s Shanghai Gigafactory was hobbled by both supply chain issues and China’s Zero Covid lockdown policies. And slumping demand could be the result of political tensions between the U.S. and China.

While Tesla’s EV market share in the U.S. hovered at about 65% for 2022, that’s down from 79.4% in 2020, and will continue to fall as new competitors come to market with Bank of America Securities’ John Murphy forecasting Tesla’s share to slide to just 11% by 2025. During the same period, both General Motors and Ford will see their share of the emerging market for BEVs grow to about 15% each.

“Tesla didn’t move fast enough … to shut the door” on its competition, Murphy said, last June.

Consider the Cybertruck, which has yet to begin production, even as the Ford sold 15,617 F-150 Lighting pickups. And waiting in the wings are the Chevrolet Silverado EV, Sierra EV and the forthcoming Ram 1500 EV. Then there’s Rivian, which delivered 15,700 electric pickups this year, and GMC, which sold 854 Hummer pickups during the sale time.

But such doom and gloom overlooks one essential point. In the U.S., EVs still only account for 5% of all vehicle sales, while worldwide, it’s 13%. In other words, the race is far from over, and Tesla’s advantage in the pole position is its to lose. Right now, it remains the one to overtake. Consider Europe, where the Tesla Model Y is the continent’s most popular EV, and its most popular vehicle, surpassing the perennial bestseller, the Volkswagen Golf. This helps explain Tesla’s Berlin plant expansion.

The worldwide EV market is expected to grow 17% annually during the next four years, which could see all of Tesla’s new factories, all located overseas, running at capacity to meet buyer demand. Tesla expects to sell as many as 20 million vehicles annually by the end of the decade — which would give it a more than 20% share of the total global automotive market. Currently, it is running at less than a 1% share.