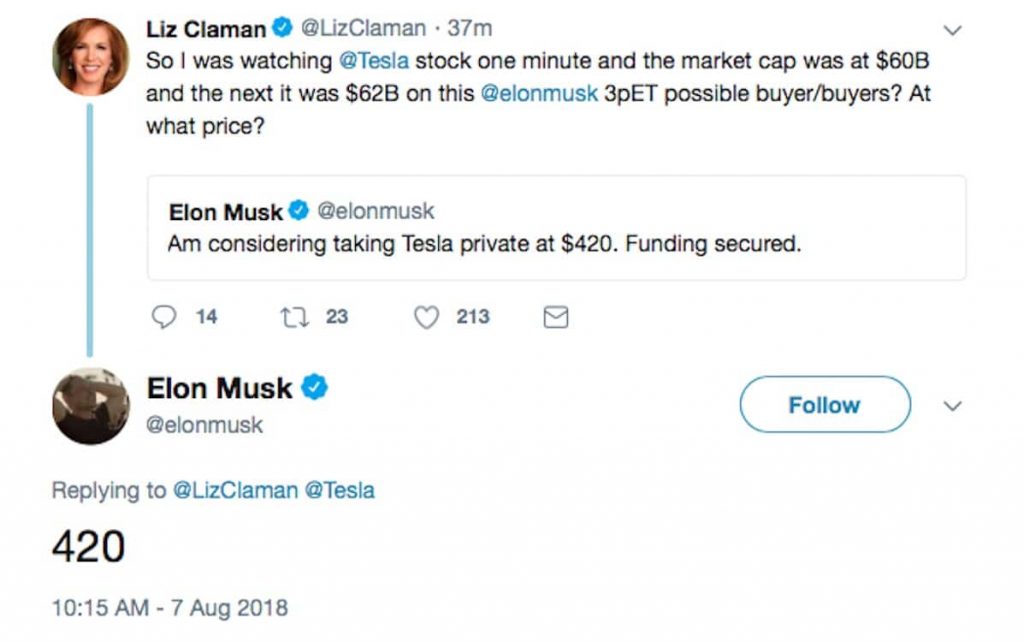

CEO Elon Musk and the Tesla board of directors are in court today defending themselves in a shareholder lawsuit that claims billions of dollars were lost due to Musk’s public statements concerning a plan to take the all-electric automaker off the stock market back on Aug. 7, 2018.

Musk tweeted that funding had been secured to buy the company’s outstanding stock at $420 per share. Total outstanding stock was then valued at about $72 billion. He tweeted, “Funding secured,” and “Investor support is confirmed,” and finally, “only reason why this is not certain is that it’s contingent on a shareholder vote.”

Musk has also stated the funding was intended to come from the Saudi Arabian sovereign wealth fund. He held several meetings with Yasir Al-Rumayyan,who manages that fund. Al-Rumayyan is on record as being unwilling to testify about the plans.

After Musk’s announcements, Tesla stock briefly surged and then dropped, wiping out about $14 billion in market capitalization. The suing shareholders have not requested a specific amount in damages, but it could cost the CEO or the company billions. Musk’s current fortune is about $132 billion, and the company’s board has denied corporate responsibility for Musk’s actions.

A skeptical judge

The case has landed in the courtroom of U.S. District Court Judge Edward Chen, who has already ruled that Musk’s tweets were “untrue and reckless.” Further, the judge denied Musk’s request for a change of venue to Texas. Musk argued that after his disastrous takeover of Twitter, it would be difficult to empanel a jury that is not biased against him. Chen countered that any public impressions of Musk are due to his own actions.

Jury selection was scheduled to begin today, and it’s unclear when a jury will be finalized. The task before the jurors will be to determine if Musk fraudulently influenced investors and whether he did so in full knowledge that his claims were unsupportable. If the jury finds that Musk defrauded investors, it will also decide the amount of the damages to award.

For his part, Musk plans to argue that he had good reason to believe that funding had been secured and that his statements were true. The Securities and Exchange Commission has already made that line of argument more difficult for him, having stated the claims were not appropriate and levying a fine of $40 million against Musk and Tesla. The billionaire and the company each paid $20 million of that fine.

Only the first lawsuit

Although Tesla’s stock dropped in the wake of Musk’s 2018 claims, it later rebounded and accounting for stock splits currently sits at about six times the value it had in 2018. That may complicate the plaintiffs’ case for damages. However, Tesla stock has once again taken a dramatic reduction in value after Musk purchased social media giant Twitter and spent most of the past six months focused on the company as a personal project and political platform for his idiosyncratic views.

Whatever happens with the current suit, it’s certain that new lawsuits will be forthcoming from Tesla shareholders who believe the company had a right to a full-time CEO who was not making himself a public controversy. Both Musk’s and Tesla’s legal jeopardy may just be getting started.