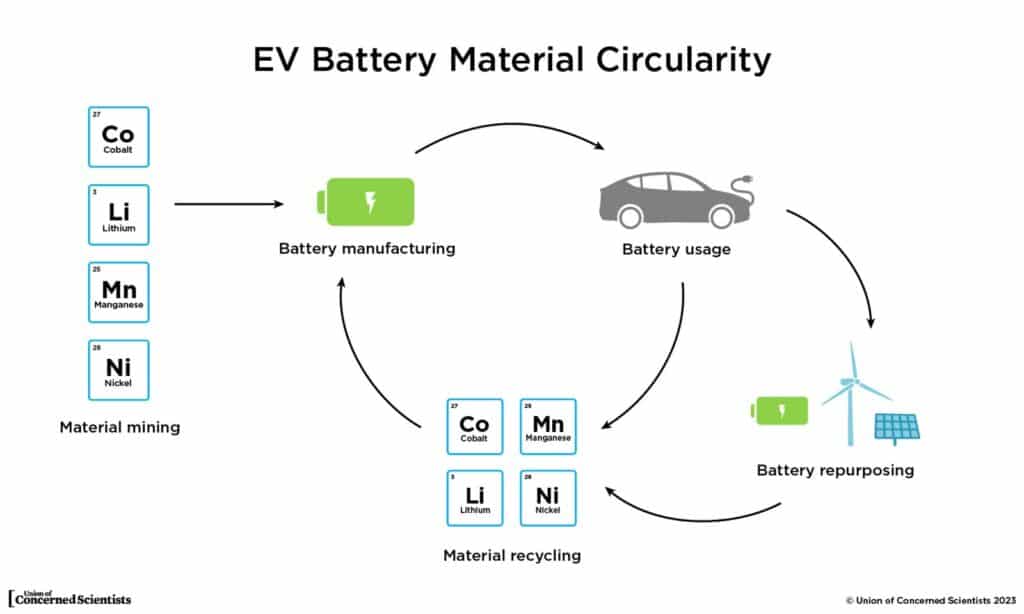

As EVs go from niche to mainstream automakers are facing serious challenges lining up supplies of critical materials like lithium, nickel, cobalt and manganese. But such shortages may be a relatively short-term problem. Within the next decade, as much as 80% of the key ingredients in EV batteries could come from recycling, much as is the case today with the lead-acid batteries in conventional vehicles.

On Monday, Honda announced an agreement with Ascend Elements, a Massachusetts-based battery recycler. “Through this collaboration, Honda will seek to obtain a consistent supply of nickel, cobalt and lithium that Ascend Elements reclaims from recycled lithium-ion batteries,” the automaker said in a statement. “Honda will then utilize these resources in its battery supply chain for electrified vehicles produced by Honda in North America.”

“Increased battery recycling and material circularity is necessary for a sustainable battery industry,” Jessica Dunn, a senior analyst in the Clean Transportation Program at the Union of Concerned Scientists, wrote in a new blog post on Monday.

Honda isn’t alone

Honda is by no means the only automaker looking to supplement — and, long-term, potential-replace — the need for newly mined metals for its EV batteries. Tesla, Volvo, Audi and Ford are among the EV manufacturers that have laid out aggressive recycling plans. Most automakers are expected to follow.

Ford, for example, has teamed up with Redwood Materials which is already working with Tesla and its battery partner Panasonic. Redwood will operate a battery recycling center at BlueOval City, the 5 square-mile EV manufacturing complex Ford plans to open near Memphis by 2026.

The demand for metals like lithium, cobalt and magnesium is already growing at an exponential rate, EVs surging from less than 1% of the U.S. new car market in 2019 to more than 5% last year. Bank of America Research estimates the figure could reach 20% by mid-decade, and President Joe Biden has set a target of 50% by 2030.

Finding enough raw materials

Some automakers already face problems getting enough of those materials to meet production targets, especially as prices have skyrocketed. Lithium carbonate, the most commonly used raw form of the namesake metal in lithium-ion batteries, has gone from as low as $36,000 a ton in early 2021 to a high of as much as $600,000 last November. It’s settled back a bit but still runs just under $400,000.

New sources are coming onboard. General Motors, for one, hopes to extract that metal from the aquifers under California’s Salton Sea. Yet, even then, there’s widespread agreement that throwing away old batteries and using fresh metals for new ones is an onerous approach.

To reach the point where EVs replace vehicles using internal combustion engines, ”We can’t rely on using virgin materials out of the ground,” said Sam Abuelsamid, principal auto analyst with Guidehouse Insights. Recycling “is essential,” he added, stressing in an interview, “We can’t be putting tens, even hundreds of millions of end-of-life batteries into landfills. It’s not environmentally or economically feasible.”

“End-of-life” batteries begin piling up

At a minimum, estimates RePurpose, one of a growing list of recycling companies, there will be more than 150,000 tons of end-of-life EV batteries needing to be recycled by the end of the decade. And that’s just a start.

If EVs follow the same pattern as vehicles using gas and diesel engines, they’ll typically be on the road for a dozen years or more — with the latest generation of lithium batteries expected to last as long as the vehicles they’re powering. As a result, it really only will be in the mid-2030s that significant masses of old EV batteries will start piling up.

Other options

There are other options. Research firms like the Boston Consulting Group and AlixPartners foresee a market for so-called “second-life batteries.” Those packs that retain 70% or more of their original capacity might find new applications, such as providing back up power at grocery stores, factories, even as regional backups on the energy grid where they could prevent blackouts and brownouts.

But the expectation is that the vast majority of end-of-life batteries will be recycled, their raw materials being repurposed for the next generation of EVs.

There’s already solid precedent. According to the EPA, about 80% of the lead and plastic in a lead-acid battery is recycled for reuse. Abuelsamid and other experts see similar numbers in the future for EV batteries.

New batteries out of old

A representative for Ascend said it has already put together “multiple deals … with multiple automakers.” But neither Ascend nor Honda are offering details about their own alliance. Honda noted it expects to accelerate its shift to EVs once its first long-range model comes to market in 2024, and its expecting them to account for more than a third of its sales in the U.S. by the end of the decade.

Ascend is using a technology developed at the Worcester Polytechnic Institute, relying on water and acid to extract metals such as lithium, nickel and cobalt — which will be repurposed for new battery cathodes.

More broadly, recyclers “can recover 95% to 98% of key materials from a recycled battery,” said Abuelsamid.

Recyclers rev up

There are more than a dozen such companies getting into the battery recycling business, with Redwood becoming one of the industry leaders. It’s already recycling about 6 gigawatt-hours of batteries annually for Tesla and Panasonic, noted Abuelsamid, and is setting up a plant in Georgia capable of handling 100 gWh of end-of-life batteries. That’s the equivalent of 1 million to 1.5 million fully electric vehicles, depending upon the size of their battery packs. By 2030, Redwood has laid out a target of 500 gWh of recycled lithium-ion batteries annually.

“Estimates show that in 2050, the United States can meet about half of EV demand for cobalt and nickel and a quarter of lithium with minerals recovered through recycling,” Dunn, of the Union of Concerned Scientists wrote in her blog.

The payoff, she and other experts agree, comes in the form of less impact on the environment through mining, as well as lower, or at least more stable, costs for the key materials needed for EV batteries.