It is one of the defining competitions of our age: The countries that can make batteries for electric cars will reap decades of economic and geopolitical advantages.

The only winner so far is China.

Despite billions in Western investment, China is so far ahead — mining rare minerals, training engineers and building huge factories — that the rest of the world may take decades to catch up.

Even by 2030, China will make more than twice as many batteries as every other country combined, according to estimates from Benchmark Minerals, a consulting group.

Here’s how China controls each step of lithium-ion battery production, from getting the raw materials out of the ground to making the cars, and why these advantages are likely to last.

MINING

Chinese companies have stakes in producers on five continents.

Electric cars use about six times more rare minerals than conventional cars because of the battery, and China gets to decide who gets the minerals first and at what price.

Although China has few underground deposits of the essential ingredients, it has pursued a long-term strategy to buy its way into a cheap and steady supply. Chinese companies, relying on state assistance, acquired stakes in mining companies on five continents.

China owns most of the cobalt mines in Congo, which has the majority of the world’s supply of this scarce material needed for the most common type of battery. American companies failed to keep up and even sold mines to their Chinese counterparts.

As a result, China controls 41% of the world’s cobalt mining, and the most mining for lithium, which carries a battery’s electric charge.

Global supplies of nickel, manganese and graphite are much larger and batteries use only a fraction. But China’s steady supply of these minerals still gives it an advantage. China’s investments in Indonesia will help it become the largest controller of nickel by 2027, according to forecasts by CRU Group, a consulting firm.

Graphite is mostly mined in China. U.S. producers synthesise graphite at much greater cost.

Western countries also own mines abroad, and are trying to catch up with China. But they have been more reluctant to put money into countries with unstable governments or poor labor practices. And they have been slow to ramp up their own production.

A new mine can take more than 20 years to reach full production. Although the United States is investing to tap its significant lithium reserves, the effort has run into a host of local and environmental concerns.

REFINING

Most of the raw material is shipped to China to be refined.

Regardless of who mines the minerals, nearly everything is shipped to China to be refined into battery-grade materials.

Once ore is taken from the ground, it is usually pulverised and then treated with heat and chemicals to isolate the mineral compounds. The process is wasteful: Cobalt generates about 860 pounds of waste rock for each pound of refined cobalt powder.

Refining needs huge amounts of energy. Battery minerals require three to four times as much energy to make as steel or copper. The preferred form of lithium, for example, needs to be heated, steamed and dried. Supported by the government with cheap land and energy, Chinese companies have been able to refine minerals at larger volume and lower cost than everyone else. This has caused refineries elsewhere to close.

Refining also often causes pollution, and Chinese refineries benefit from less stringent environmental regulations. Grinding graphite causes air pollution. Processing nickel generates toxic waste, which must be disposed of in special structures in the ocean or underground. Experts say that using more sustainable methods to process battery minerals drives up costs.

Today the United States has little processing capability. A refinery typically takes two to five years to build. Training workers and adjusting equipment can take additional time. Australia’s first lithium refinery, which has some Chinese ownership, was approved in 2016 but failed to produce battery-grade lithium until last year.

COMPONENTS

China makes most of the parts that go in a battery.

China became the largest battery producer partly by figuring out how to make battery components efficiently and at lower cost.

The most important component is the cathode, which is the battery’s positive terminal. Of all battery materials, cathodes are the most difficult and energy intensive to make. Until the past several months, the most common cathode used a combination of nickel, manganese and cobalt, also known as NMC cathodes. This formula allows a battery to store a lot of electricity in a small space, providing an electric car with longer range.

China has invested in a cheaper alternative that has now taken half the cathode market. Known as LFP, for lithium iron phosphate, these cathodes use widely available iron and phosphate instead of nickel, manganese and cobalt.

For Western countries, LFP is an opportunity to bypass bottlenecks in the mineral supply. But China produces almost all the world’s LFP.

Today the United States makes only about 1% of the world’s cathodes, all of which are NMC. American companies are interested in LFP, but they must team up with Chinese companies that have the experience producing it.

Chinese companies make most of the battery’s other components. They dominate the production of anodes, the negative end of a battery. China also sells the most separators, a layer that goes between the cathode and anode to prevent short-circuiting. Electrolytes, made of mostly lithium salts and solvent, are needed for conductivity, and the top four electrolyte producers in the world are Chinese.

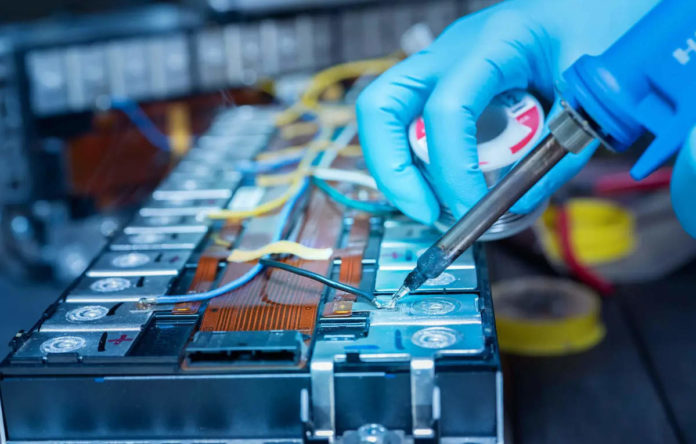

ASSEMBLY

China also makes the most batteries and the most cars.

China has the most electric cars on the road and nearly all of them use Chinese-made batteries. In 2015, Beijing enacted policies to block foreign rivals and raise consumer demand. Chinese battery manufacturers such as CATL and BYD grew at the expense of their Japanese and South Korean competitors and became the largest in the world.

Eight years later, the Biden administration is now pursuing a similar strategy to foster battery development in the United States.

But in a business with huge capital costs and thin profit margins, Chinese companies have a big head start after years of state funding and experience.

Battery assembly is complex and technical. To make one, cathode and anode materials are attached to thin metal sheets each about one-fifth the thickness of a human hair. These are then stacked with separators, moistened with electrolytes, and rolled up. The entire process needs to take place in rooms that minimise air particles and moisture.

China can build battery factories at nearly half the cost of countries in North America or Europe, according to Heiner Heimes, a professor at RWTH Aachen University in Germany. The main reasons: Labor costs are lower, and there are more equipment manufacturers in China.

American investors remain wary about putting money into electric vehicles. Traditional cars are still profitable, American workers need to be trained in new skills, and U.S. government incentives to help the EV industry could disappear with the next presidential election cycle.

China has spent more than $130 billion on research incentives, government contracts and consumer subsidies, according to the Center for Strategic and International Studies. Electric car buyers in China get tax rebates, cheaper vehicle registration, preferential parking and access to an extensive charging network. China’s investments have allowed the country to lead the world in production, equipment and product design.

Experts say it is next to impossible for any other country to become self-reliant in the battery supply chain, no matter if it has cheaper labor or finds other global partners. Companies anywhere in the world will look to form partnerships with Chinese manufacturers to enter or expand in the industry.

“There is no way anybody is going to become successful in electric vehicles without having some type of cooperation with China, either directly or indirectly,” said Scott Kennedy, a senior adviser at CSIS.