The 2023 Chevrolet Bolt will almost certainly be the most affordable EV for 2023, but will it qualify for the new Federal tax credit? That remains unclear, and General Motors is not alone in that uncertainty.

The new law restricts the tax credit to EVs assembled in North America, and places further restrictions on income, vehicle price and where battery materials and components are made. Those last two restrictions, on battery minerals and component sourcing, could be the most difficult requirements for any automaker to meet.

Still, most automakers put a positive spin on the bill’s passage and its impact.

“General Motors welcomes the U.S. Senate’s passage of the Inflation Reduction Act that includes provisions to accelerate the adoption of electric vehicles and strengthen American manufacturing and jobs,” the company said in a statement to TheDetroitBureau.com.

“GM is already making historic investments in the U.S., and this legislation will help drive further investments in American manufacturing, clean energy and sustainable, scalable, and secure supply chains as we work to establish the U.S. as a global leader in electrification.”

As for which GM vehicles may be eligible for the tax credit, the automaker is understandably cautious, saying, “We are not able to speculate which vehicles may or may not qualify in the near-term, but do think the legislation aligns very well with GM’s long-term plans and over the life of the credit we intend to offer a number of eligible vehicles.

“While some of the provisions are challenging and cannot be achieved overnight, we are confident we can rise to the challenge because of the domestic manufacturing investments we are making to secure a supply chain for batteries and critical minerals.”

It is also important to point out that while a tremendous amount of analysis is being performed, the U.S. government will provide official guidance after the bill is signed into law. All automakers will know more about their potential qualifications once the guidance is issued.

Bringing the supply chain home

At the moment, many of the minerals used to make EV batteries and rare earth magnets are mined in China. According to a 2021 report by Wards Auto, “China currently controls the processing of nearly 60% of the world’s lithium, 35% of nickel, 65% of cobalt and more than 85% of rare earth elements.”

Getting materials from China is essentially an instant fail when it comes to securing a tax credit for a vehicle under the rules. Together with mining and refining interests, and with battery research and production companies, GM is looking to change those percentages.

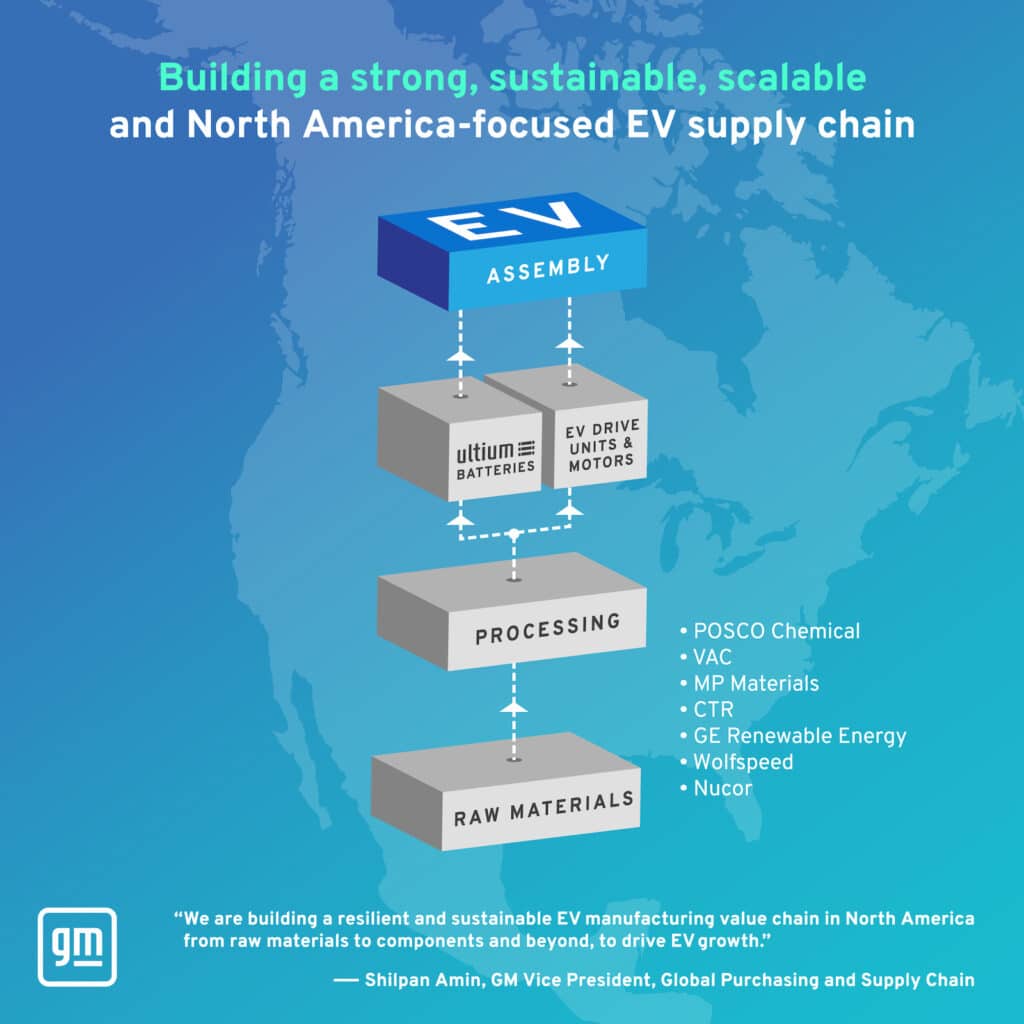

The company has obtained binding agreements securing enough battery raw materials to support a corporate goal of 1 million units annually, produced in North America, by the end of 2025. This includes lithium, nickel, cobalt and a full Cathode Active Material (CAM) supply. During its earnings call July 26, 2022, GM announced agreements with Livent for lithium hydroxide and LG Chem for CAM.

On the manufacturing side, GM has invested more than $7 billion partnering with LG Energy Solution in a joint venture called Ultium Cells LLC. The venture aims to produce Ultium battery cells in the United States, creating an estimated 4,100 jobs in battery production.

Where the minerals are located

Although the mining of various required minerals takes place all over the United States, certain key mineral deposits have been located in the desert Southwest. For example, Controlled Thermal Resources (CTR) is drilling in Southern California’s Imperial Valley near the Salton Sea to obtain lithium.

Using geothermal energy produced onsite, the company extracts a hot, soupy brine from the ground while using released steam to generate electricity. The company then uses the electricity to extract lithium hydroxide and lithium carbonate from the brine. Both compounds are used in battery production.

Farther north, MP Minerals is mining rare earth elements in the Mojave Desert in Mountain Pass, California. The company received a $35 million contract from the U.S. Department of Defense to design and build a facility to process those elements. MP Minerals and GM have announced that the mining and processing company will supply rare earth alloy flakes and neodymium-iron-boron magnets for GM’s EV production.

MP’s Fort Worth, Texas magnetics factory will source refined feedstock from Mountain Pass and transform it into finished products, delivering an end-to-end U.S.-based supply chain, including mining and refining, metal, alloy, and magnet manufacturing, and recycling.

The company also states, “Mountain Pass is a closed loop, zero-discharge facility with a dry tailings process that recycles more than 1.7 billion liters of water per year. To optimize for efficiency and sustainability, byproduct generated from alloy and magnet manufacturing will be recycled in a closed loop to every extent possible.”

One partner helping GM produce Cathode Active Material in North America is the South Korean firm POSCO Chemical. The two companies are working towards building a new facility in Bécancour, Quebec to process CAM, a battery material that includes processed nickel, lithium and other materials representing about 40% of the cost of a battery cell.

The facility is expected to come online in early 2025, and POSCO will supply South Korean CAM until then. South Korean company LG Chem is also under contract to supply more than 950,000 tons of CAM to GM between 2022 and 2030. GM and LG Chem are also exploring opportunities to build a North American production facility.

Finally, Swiss company Glencore will supply Australian cobalt to GM. Cobalt is added to lithium-ion battery cathodes to improve energy density and battery longevity.

Free trade and entities of concern

One of the provisions in the new EV tax credit that may allow vehicles to qualify is the stipulation that minerals and battery components may be made in nations that hold a free trade agreement with the United States. Both Australia and South Korea hold such agreements, along with Canada, Mexico, and a number of Central and South American nations. Thus, minerals obtained from those nations do qualify toward the percentage of battery composition considered domestic.

The other side of that is a requirement in the bill that no materials may come from any entity listed as a “foreign entity of concern.” This list, created by the Bureau of Industry and Security at the U.S. Department of Commerce, identifies foreign persons, business entities, or governments that are subject to trade restrictions. The practical effect of this restriction is to discourage sourcing these materials from China.

The road to battery independence

The Inflation Reduction Act’s requirements for domestically produced battery minerals rise by 10% each year from 2023 to 2027, ending at 80 percent. Domestic production of battery components rises to 100% by 2029. That’s a steep and fast ramp to climb, but automakers like GM have been preparing for these requirements.

For those automakers left out of the new tax credits by virtue of final assembly locations outside North America, the battery sourcing requirements won’t matter at all. They’re not eligible for a tax credit anyway, so they can continue to source battery materials worldwide, at least for the moment.