Electric Ford Mustang Mach-E on display in Frankfurt Germany – May 2023

Victor Golmer/iStock Editorial via Getty Images

The latest new-vehicle registration data from credit reporting company Experian confirms other evidence that points to slowing of sales growth of BEVs in the U.S. The automakers are alert to the trend and are beginning to take measures such as price-cutting and adjusting production to make BEVs more attractive and limit losses.

Surveys suggest that insufficient charging infrastructure, range anxiety and premium pricing of BEVs are prime contributing factors to the slowdown. A countervailing trend is the large number of new models entering the U.S. from a number of manufacturers, providing more consumer choice. As of March, 40 BEV models were available in the U.S.

The Biden administration has set a goal that half of all new-vehicle sales in the U.S. will be BEVs by 2030.

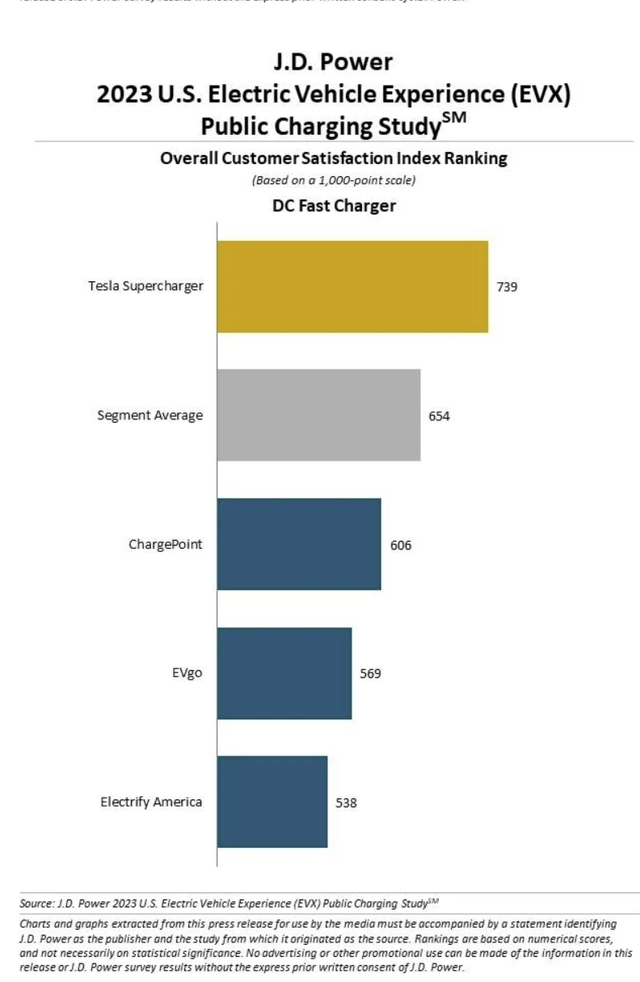

In a study released Wednesday by J.D. Power, satisfaction with public charging as measured during the first half of the year and based on responses from 15,000 users of BEVs and plug-in hybrids fell to its lowest recorded level.

JD Power charging study (JD Power)

Tesla, the BEV market leader, isn’t immune to the slowdown in demand. Tesla announced a $10,000 reduction in price on its flagship Model S sedan and Model X crossover by introducing new versions with less range and slower acceleration, according to the company’s website.

Early adopters

“It seems like early-adopter demand has nearly been met, and the EV market will have to start targeting a more mainstream consumer — which is challenging given the price points of the vehicles available and the lack of charging infrastructure,” Jessica Caldwell, executive director of insights at Edmunds, told Automotive News.

General Motors (GM) has reversed course on discontinuation of its lowest-price BEV, the Chevrolet Bolt, which accounts for the bulk of its sales. Bolt sells for less than $30,000 and soon will feature GM’s latest Ultium battery technology, which the automaker bills as an improvement over the battery that suffered a number of fires, resulting in a costly recall.

In July, Ford raised its annual pretax profit expectation, while forecasting a full-year loss of $4.5 billion on BEV sales, 50% higher than projected earlier this year. At the same time, Ford has signaled that it intends to quadruple sales of vehicles powered by gas-electric hybrids over the next five years. Hybrids don’t require recharging and lower carbon emissions compared with gasoline engines.

Hybrids gain cred

Ford’s increasing reliance on gas-electric hybrids lends credibility to the strategy of Toyota Motor Corp., which has been cautious with the introduction of BEVs and also leans heavily on gas-electric hybrid powertrains until such time as U.S. charging infrastructure and BEV demand improve.

“We’re not shying away from our EV plans,” said Ford chief financial officer John Lawler during a call with analysts. “This is not going to be a straight line. There’s going to be some bumpiness as we move along.”

Stellantis N.V., the Netherlands-based parent of Jeep, Chrysler, Dodge and several European-based brands, has noted the absence of BEVs selling for $25,000, a price and “sweet spot” that could make them more attractive to mainstream and low-income consumers. Provided, of course, that Stellantis could sell such a vehicle profitably.

Carlos Tavares, Stellantis’s CEO, told Automotive News that manufacturing BEVs which are affordable for “middle class” buyers should be a topic of discussion between automakers and the United Auto Workers union. The UAW, under new leadership, has adopted a contentious posture toward Ford, GM and Stellantis, demanding steep pay hikes toward a new labor contract. The union this week urged its members to authorize a strike. The current contract expires on Sept. 14 – and Detroit automakers can ill afford terms that will increase already non-competitive labor costs compared with automakers such as Toyota and Hyundai operating non-union U.S. assembly plants.

Labor costs are estimated at be about $55 an hour at Toyota vs. about $64 an hour for workers at Big Three plants represented by the UAW. Sources speaking on condition of anonymity to Bloomberg have said that UAW demands could add roughly $80 billion in additional labor costs to the Detroit-based automakers.

Price premium

According to data from Cox Automotive, parent of Kelley Blue Book, the average transaction price for electric cars was $53,438 in June 2023. Gas-powered vehicles transacted at an average of $48,808. Tesla contributed to a substantial drop in EV prices since late last year as it cut prices. Yet the costs of new battery plants and the mining or purchase of minerals is steep, compared with the sunk costs in gasoline engines and hybrid system.

2023 Chevrolet Bolt EUV Redline (GM)

The fundamental questions for investors and potential investors in automotive equities revolve around the financial risks automakers are undertaking by pressing ahead full speed toward BEVs, with the assumption of steady growth in consumer demand. The latest market share pause could be temporary – or it could indicate substantial consumer resistance, which will translate into slow-than-expected adoption of BEV technology.

GM, Ford and Stellantis each have pickup truck models and other assets such as Stellantis’s Jeep franchise that are highly profitable and can help the companies stay viable in the event that BEV adoption takes longer than forecast. But how much could the balance sheet of each company struggle under the weight of tens of billions of dollars each is investing in BEVs, with a longer return on investment than forecast?

In bygone days, the Detroit Three only had to prove they could survive the periodic cyclical downturns that ravaged their finances. Downturns remain relevant – but now incumbent automakers must withstand an additional and equally dangerous hazard: The wholesale (and government mandated) technological shift away from fossil fuels to electrification.

As government regulators ratchet up fuel-efficiency rules designed to eliminate the internal combustion engine, Detroit auto executives may have to explain to their political masters that forcing one or more of the companies out of business in the name of controlling global climate change may bring more liabilities than benefits. Detroit is maintaining a brave face for the time being.

As for my ratings, F, GM and STLA remain on HOLD