Could Mary Barra be right? Seems so.

About 18 months ago, General Motors top executive told a room full of journalists the company’s research showed vehicle owners were willing to pay $135 a month for in-vehicle subscription-based services.

In the months following, other auto executives, notably Stellantis CEO Carlos Tavares, made similar assertions. Stellantis CEO Carlos Tavares forecast his company would generate revenues of more than $22 billion annually by the end of the decade.

In essence, the notion doesn’t seem entirely far-fetched as add-ons like Sirius/XM satellite radio and GM’s OnStar telematics packages already snatch money out of the bank accounts of vehicle owners each month.

Old thoughts changing

But $135 each month? A study by Cox Automotive in April 2022 seems to support the skepticism, suggesting the number was closer to $35 a month. But, like everything else in the auto industry these days, the landscape changes quickly — and as consumers get more time to use these kinds of services.

Once consumers experience connected services, they are overwhelmingly satisfied and likely to resubscribe, according to a recent global consumer survey of nearly 8,000 consumers conducted by S&P Global Mobility.

“Consumers are welcoming to the idea of subscriptions, because it gives them exposure to features or technology that they may not have had in the past,” said Yanina Mills, senior technical research analyst at S&P Global Mobility.

In a subset of about 4,500 respondents who had experienced a free trial or an existing subscription on a model year 2016 vehicle or newer, 82% said they would definitely or probably consider purchasing subscription-based services on a future new vehicle purchase.

Mind-set shift

A variety of factors are driving the change in opinion. First and foremost, automakers quickly are figuring out what kind of subscription-based services to offer. So when BMW “offered” to let vehicle owners pay for heated seats on a monthly basis, people were upset because that’s something they believe they should pay for once, not in perpetuity.

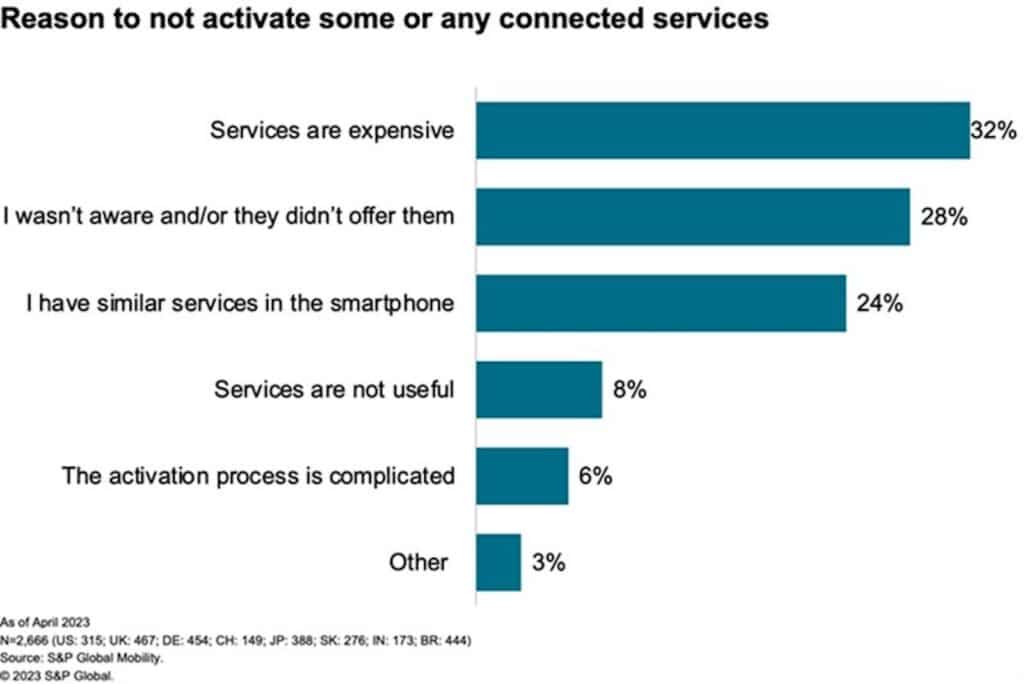

Also, many were seemingly unaware of what was being offered to them. More than one in four respondents — 28% — either did not know that connected services were available, and/or noted the dealer did not offer (or even mention) them, S&P noted.

In-vehicle exposure is even better than education for growing demand and fostering satisfaction and retention with these services and brands. Forty-five percent of respondents had the service activated at the dealership, typically as part of a free trial period. That improves the odds of growing subscribers.

“It’s all a matter of exposure,” Mills said.

That’s because, once exposed, consumers are pretty happy with their connected services subscriptions. The vast majority of previous-subscriber respondents said they were likely to renew. Satisfaction is high as well, as 85% of respondents would recommend their service to a friend.

GM’s plans

Earlier this year, GM reveal it won’t offer the free hook up for Apple CarPlay and Android Auto in its new vehicles, instead opting to improve its native system — and try to capture some of the billions of dollars automakers believe will be available to them in the future.

Fanni Li, connected car services research lead at S&P Global Mobility, said that GM is quite aggressive in this area, but warns that making the change could risk GM customer satisfaction. Also at stake: GM’s desire to generate $20 billion to $25 billion yearly through subscription services by 2030.

However, GM’s not going to get much of that total if it can’t provide services the consumers want — and at what they perceive is a good value. Paid upgrade safetyfeatures, such as high-beam assist and driving-video recorder, earned the highest satisfaction – 89% — of all connected services. Likewise, navigation

and safety/security features were the ones most desired in respondents’ next vehicles.

Also, many are used to getting subscriptions on their smart phones, potentially causing some conflicts. ADAS functionality — or heated seats — can’t be provided by smartphones, but many infotainment services are. Consumers are accustomed to using their smartphone for navigation and entertainment features.

When they pare down their subscriptions, redundancies between the vehicle and the phone likely are the first to go — and the smartphone almost always wins. S&P Mobility found that Gen Z and millennial respondents are most likely to drop connected-services subscriptions because of similar services on their smartphones.