It’s just mid-July but it’s already been a terrible, awful month for VinFast, the Vietnamese EV startup having the bottom fall out of its planned SPAC merger and U.S. stock listing, while a new sales report shows that its VF 8 battery-electric vehicle has largely been rejected by American buyers in the wake of harsh initial reviews.

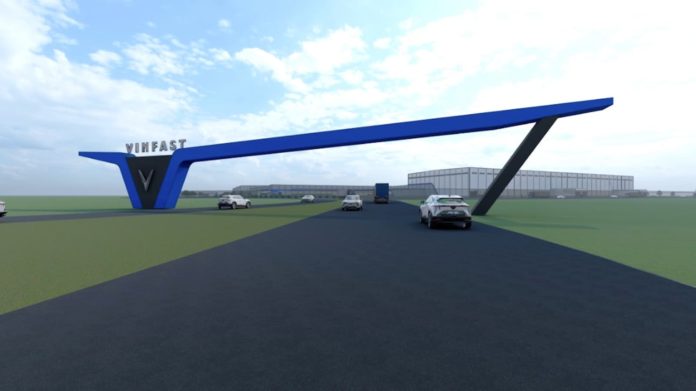

Yet, the manufacturer just announced that it will still go ahead with plans to begin construction of its $4 billion North Carolina assembly plant as early as next week.

The project is seen as essential to gaining a sustainable foothold in the growing American market for EVs, according to Le Thi Thu Thuy, the automaker’s CEO. “When it begins operations, the factory will be VinFast’s primary supplier of electric vehicles to the North American market,” she said, announcing the updated construction plans.

Sales tank

The fate of the plant had seemingly grown uncertain in recent weeks as things started to turn south for the automaker. Initial sales results for the VF 8 have been well below VinFast’s already modest expectations. Through the end of May, it delivered just 128 of the EVs, according to data from tracking service Experian. Buyers registered just one in February, 16 in March, 66 in April and 45 in May.

There appear to be several reasons for the slow takeoff in the American market. That starts with harsh reviews of the VF 8 following the first media drive of the EV in May. It doesn’t help that, at a base price of $47,200, it doesn’t qualify for the $7,500 in federal incentives available to some competitors — notably Tesla which offered the competing Model Y for a starting price of $51,380 before factoring in the federal tax credits.

Stock market listing falters

Complicating matters, VinFast’s bid to raise a planned $2 billion by going public has faltered, with no new plan immediately in site. The automaker initially hoped to stage its own IPO. When that didn’t work out it tried to follow the path taken by other EV startups, such as Lucid Motors, Faraday Future, Fisker Inc. and Lordstown Motors, taking the SPAC route. Otherwise known as a Special Purpose Acquisition Company, it’s essentially a merger specifically designed to get a company listed on one of the stock exchanges in a hurry.

VinFast was set to partner up with Black Spade Acquisition in a deal that would value the automaker at $27 billion. The deal was to have been completed today.

But shareholders of Black Spade decided to put things off by as much as a year. Meanwhile, they redeemed 80% of their shares, worth $147 million, in the Hong Kong-based company. That left just $28.6 million in the trust account. An editorial on Reuters suggested the planned SPAC deal now “belongs in the scrapyard.”

Consigned to the “scrapyard”?

“VinFast would be better off trying to fix its sales and performance teething problems away from the glare of the stock market and to rely instead on its parent and (founder Pham Nat) Vuong to provide any cash needed as they did in April — and to consign its merger to the scrapyard,” Reuters’ Antony Currie stated in a “Breaking View” editorial.

VinFast hoped to raise as much as $2 billion from a SPAC merger, money that could have helped offset its fiery cash burn rate. Even as it began selling vehicles in the U.S., it saw a 49% drop in revenue during the first quarter of 2023, with losses rising to $598 million.

VinFast set to break ground on U.S. factory

But despite such setbacks, VinFast officials have continued laying out an aggressive schedule for the U.S. market entry. Even as they try to address the numerous complaints about the VF 8, the plan calls for adding a second model, the larger VF 9, before year-end. And smaller entries, including the VF 6 and VF 7, are on tap for 2024.

And the automaker now plans to move ahead on the first, $2 billion phase of construction in North Carolina, it says. That would give it a U.S. plant capable of rolling out as many as 150,000 EVs annually.

While VinFast apparently cannot count on a SPAC deal or other stock listing in the near-term for cash, its founder, Phạm Nhật Vượng, in April pledged another $2.5 billion to keep things on track.

Construction plans could be disrupted

But even the latest construction schedule may be disrupted. The automaker has received key permits to move ahead, but it still needs a few more and submitted to the local county planning board an application for a commercial zoning compliance permit a week ago. The Chatham County authorities aren’t set to meet again until Aug. 1, however, and it’s not yet clear if VinFast will be on the agenda, reported the Carolina Journal this week.

The 2.85 million square-foot factory and ancillary operations are eventually expected to create 7,500 jobs.

Whether the compliance permit is required before ground is broken is unclear. TheDetroitBureau.com is waiting for a reply to a query sent to VinFast and will update this story when it hears more.