Evergrande and NWTN hope to restart stalled production at this Tianjin factory (Image: Evergrande NEV)

China Evergrande Group has struck a deal to sell a 27.5 percent stake in China Evergrande New Energy Vehicle to a little-known, Chinese-controlled car maker based in the United Arab Emirates for $500 million, as the electric car unit of the world’s most indebted developer seeks new funding support amid doubts over its future as a viable business.

Evergrande NEV plans to issue more than 6.1 billion new shares to be sold to NASDAQ-listed NWTN, the Guangzhou-based car maker said Monday in a filing with the Hong Kong stock exchange. Under the terms of the agreement, Dubai-headquartered NWTN (pronounced “Newton”) will gain the right to nominate a majority of Evergrande NEV’s board of directors.

The transaction is expected to close in the fourth quarter, contingent on the progress of the parent company’s ongoing debt restructuring and the confirmation of a debt repayment plan by “a certain creditor” of Evergrande NEV, as well as regulatory and shareholder approvals.

“The group is currently experiencing tight cash flow position but is still striving to sustain its operations,” said Evergrande NEV chairman Shawn Siu. “The group will face the risk of discontinuation of business without access to a new round of significant funding.”

Chinese Leadership

Led by Chinese businessman Alan Wu, NWTN assembles vehicles in Abu Dhabi and has offices in China and New York, according to its website.

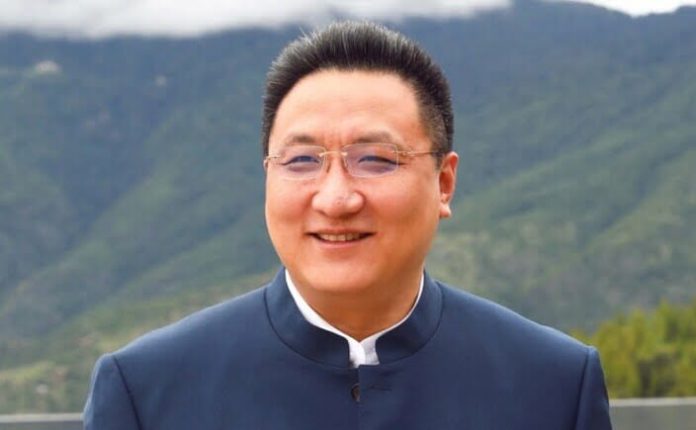

NWTN founder, chairman and CEO Alan Wu

Last year the firm, then known as Iconiq Motors, merged with a special purpose acquisition company controlled by Sherman Lu, the former CEO of Wanda Investment, and began trading on the US-based NASDAQ. Lu sits on the NWTN board as an independent non-executive director while Wu serves as chairman and CEO.

In a separate statement Monday, NWTN said the stake buy and partnership would “enable synergies” and help the company address the EV needs of the Middle East — though it’s unclear what value remains to be unlocked from Evergrande NEV, which last month reported a two-year loss of $11.7 billion and warned of its ability to continue as a going concern after selling roughly 1,000 cars since its establishment in 2019.

NWTN itself is far from flush, with the company’s annual report for 2022 revealing a cash balance of $212 million — less than half the amount of its proposed investment — and zero net revenue booked for that year or the previous two.

Change in Control

Should the deal be completed under the proposed terms, China Evergrande’s stake in its auto division will be diluted to 46.86 percent and Evergrande NEV will no longer be considered a non-wholly owned subsidiary of China Evergrande. As part of the agreement, NWTN has the right to nominate three directors to Evergrande NEV’s five-person board, including its chairperson.

The deal also calls for NWTN to provide RMB 600 million ($82.4 million) in transitional funds to be credited to an escrow account within five working days after announcement of the agreement, with that cash earmarked for production of Evergrande NEV’s Hengchi 6 and Hengchi 7 models at its Tianjin factory.

Wu founded what is now NWTN in Tianjin in 2014, according to an account at mainland news site ThePaper.cn, with the company then known as Tianjin Tianqi Group and using the brand name Iconiq. The name was formally changed to Iconiq in 2019 when the company received a permit to begin producing cars. The company changed its name from Iconiq to NWTN when it set up car-making operations in Abu Dhabi in June of last year.

Evergrande NEV announced in August 2021 that it would explore a stake sale after posting a six-month loss of $740 million. After plunging more than 60 percent in the wake of July’s long-overdue earnings release, the company’s HKEX-listed shares shot up 15 percent in Tuesday trading before sliding to HK$1.73 each — a 1.8 percent increase for the day.

September Reckoning

In April, China Evergrande announced that it had signed restructuring support agreements with a significant creditor group as the builder made strides towards resolving its $22.7 billion offshore debt load.

The three agreements cover the various jurisdictions and creditor classes for $19.1 billion in offshore debt. The relevant bondholders have two options: replace their bonds with new notes maturing in 10 to 12 years; or choose a combination of replacement with new notes maturing in five to nine years and conversion into a package of equity-linked instruments.

After posting a two-year loss of $81 billion in July, Evergrande learned that a Hong Kong court would hold September hearings to determine the fate of the proposed debt restructuring after a vote on the plan by the offshore creditors scheduled for this month.