The used car market remains stable with demand matching supply, but as more used electric vehicles (EVs) are defleeted, prices are coming under pressure.

Of all the battery electric vehicles (BEVs) valued at three years, 75% saw values reduce, 20% remained level, and just 5% saw values increase, according to Cap HPI.

Notable BEV ranges that have seen values reduce at three years this month, according to Cap HPI, are the Citroen C4, down by 6% or £600, the Hyundai Ioniq, which has fallen by 4.9% or £500, the Nissan Leaf, down by 5.9% or £600, and the VW ID3, which recorded a 6.1% fall, equivalent to £880.

Two vehicles that saw values increase at the same age point are the BMW iX, up by 2% or £600 and the Mercedes EQA, up by 1% or £200).

Jeremy Yea, senior valuations editor at Cap HPI, said: “The availability of electric vehicles in the used wholesale market continues to expand, offering buyers a greater selection than ever before.

“In terms of sold data, we have already received nearly 40% of last year’s total sold volume in the first three months of the year.

“However, BEVs still only make up around 4% of all the sold data we have received this year, across all vehicles of all ages and mileages, although that does increase to circa 12% for cars up to three years old.”

He added: “As the electric vehicle market continues to mature, there could be some further adjustments to come as a number of manufacturers compete on price and try to hit ZEV mandate targets.

“A continuation of strong new car offers and registration activity is likely to remain and, therefore, may further impact values. As ever, the market presents a complex picture and it’s essential to stay informed with Live values.”

Including internal combustion engine (ICE) vehicles, Cap HPI reports that average value movements at three years, 60,000 miles saw a decrease of just 0.1%, equivalent to around a £70 reduction this month (March).

It marked the third strongest March into April monthly movement since 2019.

One-year-old vehicles also decreased by a minimal 0.1%, with the five-year and 10-year age points also decreasing in value by 0.7% and 1.8%, respectively, according to Cap HPI.

Older high mileage and damaged stock continue to be the most challenging part of the market, with further deductions seen throughout the month.

Yea said: “Cars in good condition with low mileage and holding good provenance are still the most sought after within the market and across all mainstream vehicle sectors.

“These are viewed as fast-churning good retail stock, where competition remains strong despite the increase in wholesale supply levels throughout this new registration plate month.

“This injection of increased used supply into the market has certainly not dampened the desire to buy, and current supply and demand levels are still well matched.”

He explained: “Used car sales have remained healthy within an overall upbeat and stable retail marketplace.

“The consensus is that consumer enquiries remain at good levels. This return to what can only be described as ‘normal seasonality’ has been a much-needed period of stability welcomed by retailers during this important first quarter of the year.”

City Car was the strongest performing mainstream sector increasing by 1.1% or £80 at three years.

Some of the most significant increases within this sector were for Fiat Panda, up 3.4% or £225, Peugeot 108, up 1.3% or £80 and Citroen C1, up 1.1 or c. £60.

City cars remain a popular choice with buyers due to being quick sellers and affordable for consumers.

MPV’s dropped marginally by 0.1% or around £40, and SUVs remained level.

Supermini fell by 0.2% or £20, Lower Medium is down 0.3% or £40, and Upper Medium is down 0.4% or £60.

There is a continuing theme of very small drops across most sectors, but nothing untoward or out of line compared to pre-Covid historic March into April monthly movements, says Cap HPI.

Looking at fuel types in isolation, hybrid and petrol have increased by 0.5% and 0.2% respectively.

In contrast, diesel has decreased by 0.3%, plug-in hybrid is down 0.7% with BEVs further declining by 2.3% or equivalent to £525.

Sales of younger used EVs reach record levels in February

Indicata is reporting that sales of sub-two-year-old EVs recorded their highest ever market share of 11.2% in February.

This figure was assisted by a 24.9% monthly rise in sub-one-year old cars entering the market as manufacturers invested in tactical incentive campaigns to drive sales of nearly new EVs, it says.

However, Indicata believes the “big test” is likely to be the high volumes of used EVs set to come back into the market from the March 24-plate change which could put pressure on stock levels and prices.

Indicata’s UK head of sales, Dean Merritt, explained: “Each month our used EV data looks more encouraging as used prices start to fall more into line with used ICE cars.

“Our February report shows manufacturer marketing tactics are working and helping drive demand for younger used EVs. The big test will be manufacturers balancing their marketing spend between new and used EV sales.”

He added: “Incentives will drive down new car prices which should translate into lower used prices. This could make used EV prices lower than ICE cars for the first time which will further stimulate the market.”

BCA reports overall used car market stability

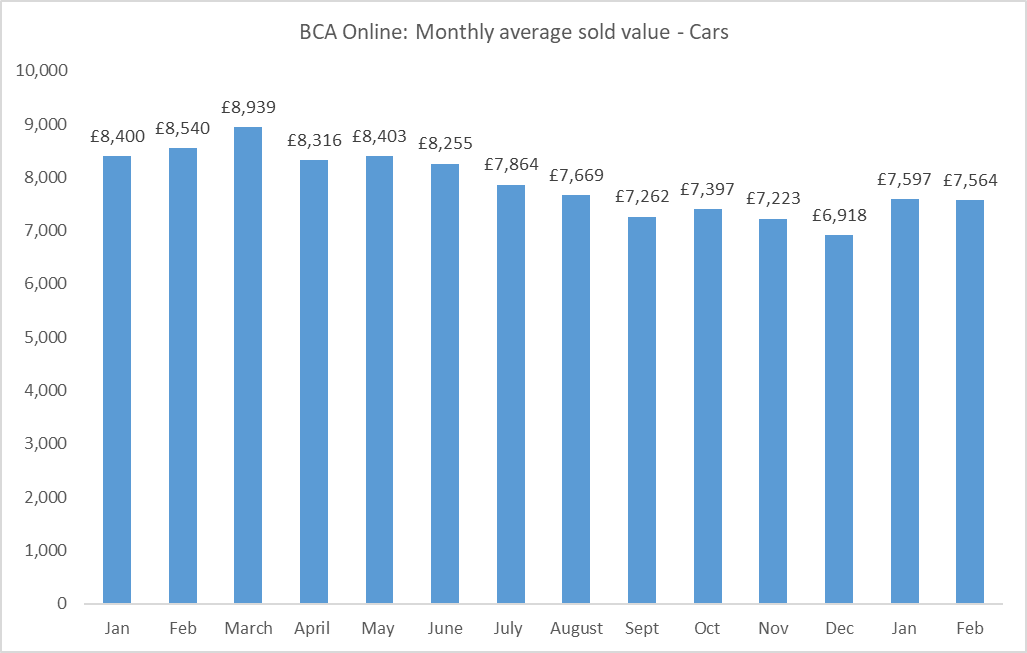

BCA reports that overall used car values remained stable in February. They averaged £7,564, down by just £33 (0.4%) compared to January, but still 9.4% ahead of the December 2023 low point.

Sold volume improved considerably as buyer appetite for stock remained high and sales conversion improved by several percentage points. Performance against guide price also improved versus January, it said.

Notably, activity from the larger car supermarkets and franchise dealers remained significant, supported by a swell of interest from a number of new buyers helping to record one of the largest monthly buyer numbers seen.

While the hot spot of the market remained in the 2 to 4-year-old sector, older higher mileage stock started to come under pressure with poorer quality product drifting further.

Chief operating officer Stuart Pearson said: “A number of larger retail outlets have continued to buy in significant volumes as they seek to replenish some particularly low inventory levels in recent months.

“The size of the BCA’s buyer base and strength of demand have all helped to contribute towards a stable used car marketplace, with vendor supply and buyer demand well-balanced across most sectors.

“Once we’ve navigated the forthcoming Easter period and some potential pressure on prices, we should remind ourselves that new registrations over the past four years have been significantly lower than traditionally seen and that potentially means increased demand for the most desirable used cars.”

He added: “With generally improving economic conditions on the horizon, there’s every expectation that retail demand for used vehicles will remain positive.

“Perhaps we should also start to be a little more optimistic about the potential for the used car market in the year ahead?”

BMW 1 series tops Aston Barclay’s March desirability index

The BMW 1 series has been the most desirable small car to pass through Aston Barclay’s auction halls in March.

Used car dealers continued to source smaller hatchbacks for their forecourts in high numbers during Q1 as they have a fast stock turn which helps cashflow in the current high interest trading environment, it said.

The Mercedes A Class and the Audi A3 were placed in second and third place. The VW Golf secured fourth place while the Ford Fiesta model in fifth is still in high demand even though prices keep rising due to the car no longer being in production.

The popular price bracket for smaller cars is currently between £10-15,000, with dealers competing to source the right models for their forecourts to meet demand.

Nick Thompson, Aston Barclay chief customer officer, said: “We have continued to see high numbers of smaller cars coming through the halls in February and March. With interest rates and cost-of-living increases, buyers are conscious of price, but many appear to still be looking to get behind the wheel of a premium brand German car when their budget allows.”

Aston Barclay’s monthly desirability index takes into consideration three key metrics: web views prior to sale, number of physical and online sale bids, and sale price achieved as a percentage of CAP average.

|

MAKE |

MODEL |

SCORE |

|

BMW |

1 SERIES |

5.8 |

|

MERCEDES-BENZ |

A-CLASS |

5.4 |

|

AUDI |

A3 |

5.1 |

|

VOLKSWAGEN |

GOLF |

5.1 |

|

FORD |

FIESTA |

4.9 |

|

FIAT |

500 |

4.8 |

|

FORD |

FOCUS |

4.6 |

|

MINI |

COOPER |

4.6 |

|

VAUXHALL |

CORSA |

4.2 |

|

VAUXHALL |

ASTRA |

4.2 |