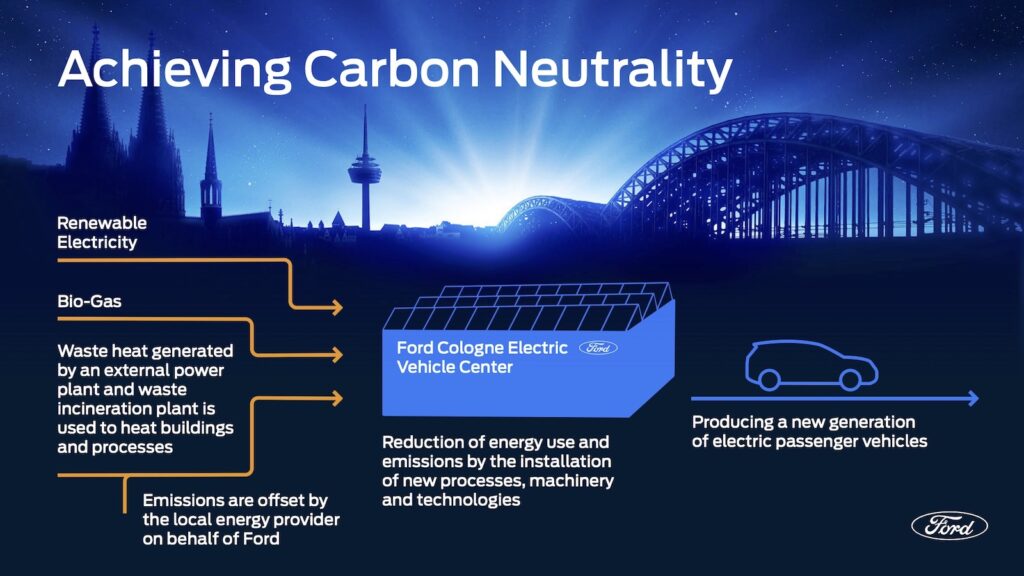

Dating back to 1930, Ford’s big assembly plant in Cologne, Germany has long been a critical part of its European operations. Now, after a $2 billion makeover, the Cologne Electric Vehicle Center will anchor the automaker’s plan to shift entirely to EVs in the EU by 2030.

Production will get underway with an all-electric version of the Ford Explorer specifically targeted for the European market. But Ford plans to have seven all-electric models targeting EU buyers by the end of 2024.

“Opening the Cologne EV Center is the start of a new generation of clean manufacturing and electric vehicles in Europe,” Ford Chairman Bill Ford said during a ceremony at the Cologne complex on Monday. “This facility will now be one of the most efficient and environmentally responsible plants in the entire industry. I am thrilled to continue working toward a zero emissions future for our children and grandchildren.”

A rapidly growing EV program

Ford last year said it will spend $50 billion on EVs through 2026, a sharp increase from the $26 billion it had previously targeted. It has announced products and manufacturing operations in a variety of different markets, primarily North America, Europe and China.

In the EU, it aims to switch entirely to EVs by the end of the decade, and is planning to have a wide range of products on sale by next year, including three passenger models and four commercial vehicles. That includes the European version of the Explore SUV, as well as a “sports crossover” expected to become the second model that will be built in Cologne.

Explorer becomes Ford’s fourth all-electric model, following the Mustang Mach-E, the F-150 Lightning and the EV version of its Transit van.

A long history

The Explorer that will be produced in Europe shares only its name with the version of the SUV marketed in the U.S. It is the product of a joint venture between Ford and Volkswagen and is based on the same MEB platform that underpins VW products such as the ID.4 crossover and the new ID.Buzz microbus.

Originally opened in 1930, the Cologne factory was one of Ford’s first — and most important — outside North America. And it has become the anchor of the automaker’s European operations as Ford has reduced its dependence upon manufacturing in Great Britain.

All told, the German factory has been tooled up to produce as many as 250,000 battery-electric vehicles annually,

Ford aims to beat the EU’s EV target

“The Electric Vehicle Center represents a fresh start and is the largest investment in the company’s history at the Ford plant in Cologne,” said German Chancellor Olaf Scholz. “This is good news for Cologne, for the auto industry in Germany, for e-mobility and for the new era.”

With EU regulators setting an aggressive target for phasing out internal combustion vehicles, Ford hopes to position itself as one of the industry’s leaders there. It plans to be selling 600,000 EVs annually on the Continent by 2026, with its global sales reaching 2 million by then. It aims to beat the EU target of 2035 by going all-electric no later than 2030.

Stiff competition

It will face some stiff competition, however. Volkswagen is rapidly ramping up its own EV program and is now rolling out an assortment of new models, such as the ID.7 and ID.Buzz.

Then there’s Tesla which opened a Gigafactory in Berlin in March 2022 at a cost of more than $5 billion. That facility has twice the capacity of Ford’s Cologne plant, at 500,000 EVs annually. And Tesla has applied for permission to bring that up to 1 million.

And a number of Chinese manufacturers are now pushing for space in the EU market. Xpeng, BYD and MG are becoming increasingly common sights in the region, with research firm Inovev estimating Chinese automakers could rival the combined share of Western, Japanese and South Korean brands by the end of the decade.