In the last few years, you might have noticed one thing: car prices have gone up by a lot. Now, although the majority of the credit for this goes to carmakers increasing prices, the Government of India also has to be blamed. Recently, we came across a video that clearly explains how you, as a car buyer, are paying for not one but two cars at once, all because of massive taxes imposed by the government.

View this post on Instagram

This video, explaining how an Indian car buyer is paying for not one but two cars at the time of purchase, has been shared on Instagram. It comes courtesy of Multiply. In this short reel, the influencer mentions that the government does not want you to drive a car alone. He then states that recently, one of his friends bought a brand-new Mahindra Thar, and after seeing the taxes, he was shocked.

Indian Government and Its Taxes on Cars

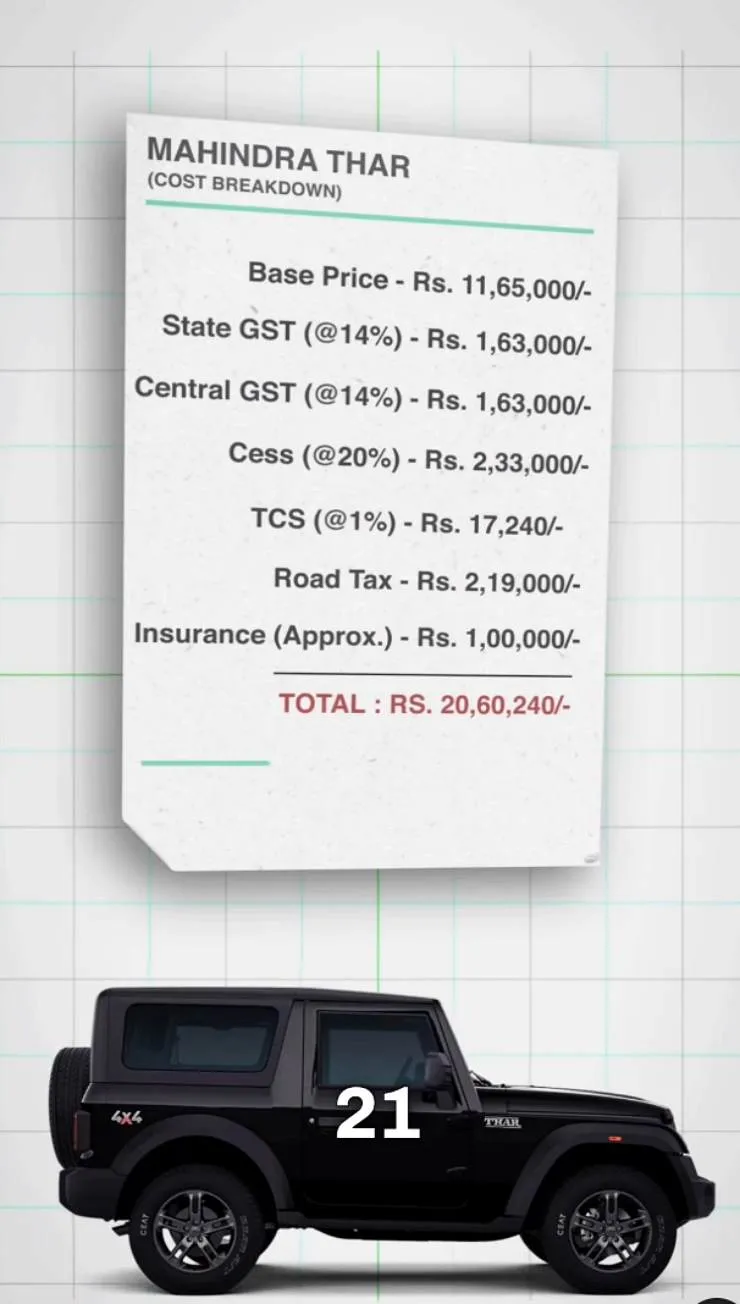

Following this, he breaks down the entire cost of the Mahindra Thar and the various taxes levied on it by the government. He starts by stating that the Mahindra Thar has an ex-showroom price of Rs 11.65 lakh. He then mentions that on this ex-showroom price, both the state and central governments charge 14 percent GST (Goods and Services Tax), or Rs 1.63 lakh each.

This means that the GST alone on the Thar is Rs 3.26 lakh. However, he continues and adds that the government, apart from the GST, also levies a CESS of 20 percent. The CESS alone comes out to Rs 2.33 lakh. On top of this, the government also adds a 1 percent TCS, which is Rs 17,240.

Finally, he concludes by stating that all of these taxes still do not include the road tax. He explains that the road tax on the Mahindra Thar, depending on the state, is around Rs 2.19 lakh. Additionally, he includes the insurance cost, which comes out to roughly Rs 1 lakh. After all of these, the final amount comes out to Rs 20,60,240.

One Car for the Price of Two

By the above calculations, the taxes and insurance on the Mahindra alone come out to Rs 8.95 lakh. Now, when compared to the original ex-showroom price of the Thar, which is Rs 2.7 lakh more than these taxes, it becomes clear that car buyers are paying almost double the price of a car to own it.

Other Taxes

Following this, the influencer adds that, apart from these taxes, the government also takes income tax on the Rs 21 lakh that the person had to earn to buy the car in the first place. Moreover, after the purchase of the car, every car buyer also has to pay taxes on fuel, tolls, and other items that will be used in the service of the car.

Additional Fuel to This Fire

We are sure that after hearing about all of these taxes, you are suffering from a mild headache. However, things do not stop here. One of the netizens on the same post highlighted another important point. He stated that for people who buy such vehicles in cities like Delhi, where there is a ban on 10-year-old diesel cars and 15-year-old petrol cars.

He highlighted that you are essentially paying this price as a lease for those many years. Once these years have passed, despite paying all of these taxes, you will be left with a paperweight as you will not be able to drive the car in the city.

If you are found driving such an old car, your vehicle will be immediately confiscated, crushed, and scrapped in front of you, and there is no law that will help you save your vehicle.

The post Indian Govt’s Massive Taxes Means You’re Buying 2 Cars Instead Of One: Explained [Video] first appeared on Cartoq.

Source link