Big things come in small packages, or so it might be for Tesla, with speculation growing that CEO Elon Musk will announce plans for a downsized, more affordable new model as part of the automaker’s “Master Plan Part Three.”

What some expect to be dubbed the Tesla Model 2 could be announced during the automaker’s annual Investor Day Wednesday. But not everyone is convinced Tesla is ready to pull off such a program, citing issues with battery production.

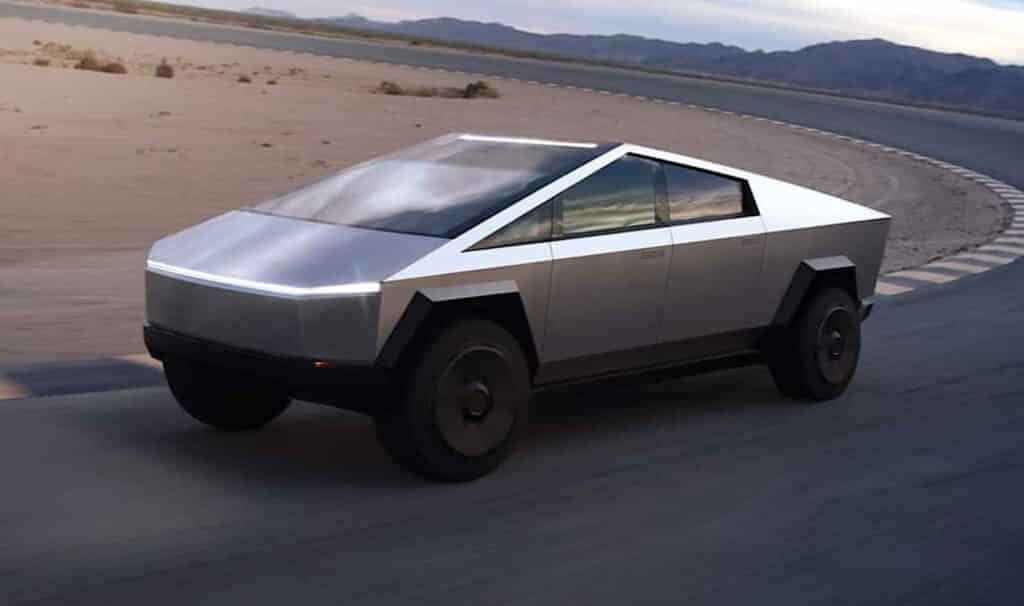

And even if Musk does want to enter a new, more mainstream segment of the emerging EV market, the question is when Tesla could pull it off. The carmaker has rarely hit its targets, either for new products or new technologies, such as the Cybertruck pickup and a fully functional version of its Full Self-Driving system.

Taking EVs mainstream

Whatever the plans for a smaller model, Musk will have some good things to talk about after suffering some serious setbacks during the final months of 2022. Tesla’s stock has rebounded sharply — though its market cap is still down by half since November 2021. Production continues to ramp up, with the new Berlin factory hitting 4,000 vehicles a week, well ahead of schedule. And, for the first time, Tesla has topped Ford in terms of brand loyalty, according to S&P Global Mobility.

While EVs have jumped from barely 1% of the U.S. new vehicle market in 2019 to nearly 6% last year, they remain niche products, in large part due to their high price — averaging more than $65,000 according to industry data. Only a handful of EVs are priced below $40,000, and those are generally older and lower-range models like the Nissan Leaf which starts at $27,800 before delivery fees.

But several manufacturers are betting they can begin winning over buyers by dropping into more mainstream segments. General Motors has promised to start the Chevrolet Equinox EV at just over $30,000 when it launches later this year.

A long-term “dream”

Getting down into the $25,000 range “has always been a dream from the beginning of the company,” Musk said in 2020.

But the CEO has waffled on plans to bring a more affordable Tesla to market. Musk told analysts last year that he had put on hold plans for a base product, widely referred to as the Model 2. But he has dropped hints more recently that the project soon might move ahead.

It’s unclear how much preliminary work Tesla has done on such a vehicle and what body style it would adopt. The Model 3 sedan currently is the brand’s entry model, starting at $43,990 before delivery fees. But SUVs are the center of gravity in today’s U.S. market, the Tesla Model Y starting at $52,990.

Still, there are challenges

With the highest EV profit margins in the industry — and some of the highest margins overall — Tesla might seem positioned to go for a new base model. But there are challenges. For one thing, there would need to be an increase in production of batteries, and more affordable ones, at that.

During a 2022 podcast, Musk pointed to the challenge of battery production. The “rate at which we can transition to sustainability is the rate at which we can grow the output of lithium-ion batteries,” he said.

Ramping up battery production is becoming an industry-wide problem. As more and more manufacturers lay out EV plans the supply of critical raw materials, notably lithium, cobalt, nickel and manganese, has been stretched thin — sharply driving up the cost for those minerals.

One possible approach would see Tesla turn to more affordable, albeit shorter-range, lithium-iron-phosphate, or LFP, batteries. The automaker is already using those cells in some products, notably in China.

Operating on Musk time

If Musk does announce plans to bring a Model 2 or similar product to market the next question would be when. If it’s already done some of the initial design and engineering that could cut the development cycle. But few analysts see that happening anytime soon — perhaps not until 2025 or beyond according to Gene Munster, managing partner at Deepwater Asset Management.

“The formula for decoding Musk is pretty simple. Take whatever time frame he has, and multiply it by two,” Munster, whose fund is a major Tesla investor, told the Reuters news service.

Tesla has rarely come close to meeting production targets laid out by Musk — the Model 3 was an exception, though by sticking to its deadline Tesla faced what the CEO described as “production hell” for more than a year and suffered both serious quality issues and erratic production schedules.

The Tesla Cybertruck isn’t expected to go into production until late this year, Musk said last month, four years after it was initially unveiled. The CEO has repeatedly failed to deliver on promises to bring out a truly hands-free version of the Full Self-Driving system. That’s now triggered several regulatory probes and lawsuits.

Upbeat news awaits investors

On the positive side, those dialing into the Investors Day webcast this week should get some upbeat news on several fronts.

The Berlin factory is now running at 4,000 EVs a week, a target originally set for the second half of March. That would be an annual run rate of 200,000 vehicles. It still has a long way to go, however. The German plant is tooled to build 500,000 vehicles annually, or about 10,000 a week.

As that factory continues ramping up, Tesla plans to divert production from its Shanghai Gigafactory to help build sales in China and other parts of Asia.

Stock price rebounds, loyalty builds

In another positive development, Tesla’s loyalty rate — which translates into higher return purchases — topped that of Ford for the first time this year, according to S&P Global Mobility. The upstart automaker was number one in five separate categories, including “Overall Loyalty to Make.” Rising loyalty, strong production, sales and earnings, along with the potential entry into a new market segment, has helped buoy demand for Tesla stock, shares bursting through the $200 mark late last week after suffering a severe plunge in the final weeks of 2022.

As of midday Monday, TSLA shares were trading around $205, up from a 52-week low of $101.81. But while they’ve gained more than 60% since the start of 2023, Tesla’s market capitalization, at roughly $640 billion, is barely half the $1.2 trillion peak it reached in November 2021.