Tesla set new benchmarks for its fourth quarter and full-year financial results, but still fell short of analysts’ estimates for the periods.

The Texas-based EV maker reported net income of $12.6 billion on revenue of $81.5 billion. Despite being 51% higher on revenue and 128% on net income, the company still fell short of the targets set by analysts. The company was expected to report earnings per share of $3.62, but analysts expected more, starting with an EPS of $4.01.

To be fair, Tesla didn’t miss by much with analysts’ consensus estimates coming in at $81.7 billion for FY 22 revenue, and it exceeded the $24.2 billion revenue estimate for the fourth quarter, although it missed the Q4 EPS expected to be $1.13. Those numbers came in at $24.3 billion and $1.07 respectively.

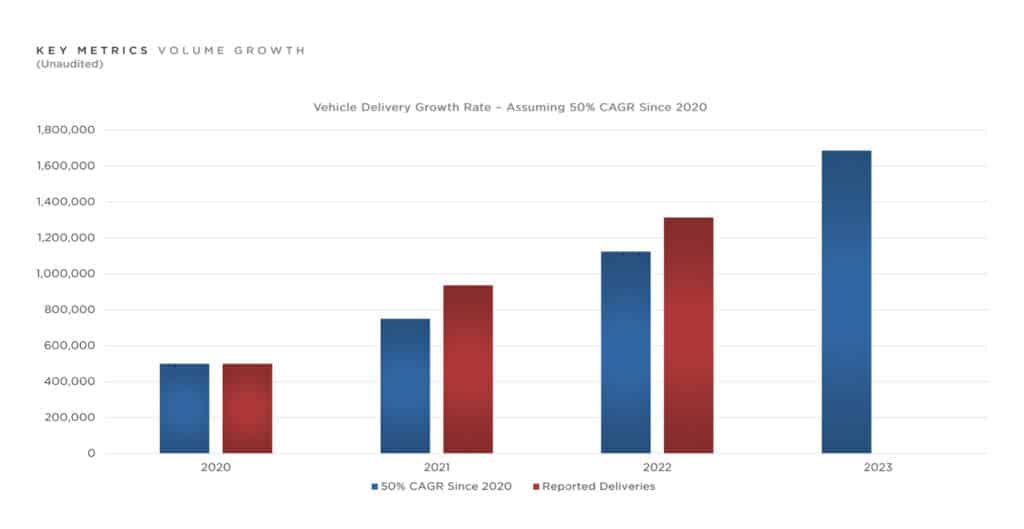

The company delivered a record 1.31 million vehicles in 2022, but that fell short of expert guessers, who predicted 1.34 million.

Other impressive results

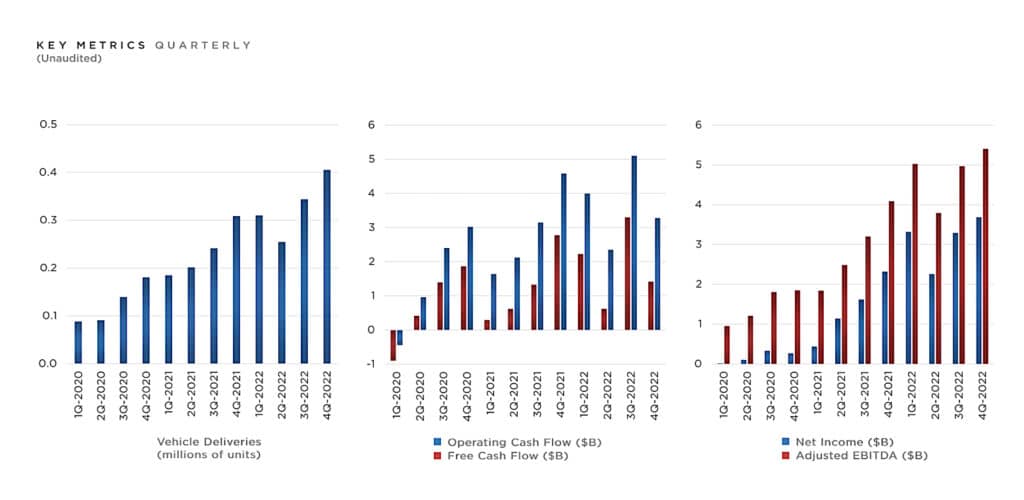

The company’s operating margin for the final stanza of the year was 16%, a number its rivals would certainly celebrate. For the full year, operating margin came in at 16.8 percent. Its adjusted EBITDA was up 65% for the full year, coming in at $19.2 billion and $5.4 billion for the fourth quarter, up 32 percent.

The company also made progress throughout the year on its delivery issues that proved costly to the automaker. Officials noted the third month of the each quarter was the busiest for deliveries, but the total percentage shrank throughout 2022.

In Q2, the busiest month accounted for 74% of the entire quarter’s sales. That shrank to just 64% in Q3 and 51% in the final quarter — Tesla’s most harried of the year.

The company saw its production rates in its Gigafactories in Austin, Texas and Berlin, Germany rise significantly. In fact, the company’s two newest plants churned out 3,000 Model Ys a week. The Austin plant produced enough 4680 cells to produce 1,000 batteries.

Expectations

While the year was a good one — especially the mad dash at the end — officials have big expectations for 2023.

“We are planning to grow production as quickly as possible in alignment with the 50% CAGR target we began guiding to in early 2021,” the company said. “In some years, we may grow faster and some we may grow slower, depending upon a number of factors. For 2023, we expect to remain ahead of the long-term 50% CAGR with around 1.8 million cars for the year.”

The company also noted it had “sufficient” liquidity to fund its current product cadence as well as development. It also made a point noting its long-term capacity expansion plans, which would include the $3.6 billion plan to expand Gigafactory Nevada, $776 million in Texas for the Austin plant and another $1 billion in Indonesia.