If there is a strike in the auto industry this fall, it will be the fault of Detroit’s automakers, General Motors, Ford and Stellantis — the UAW claims — for failing to meet the unions demands for an equitable contract, which repays members and retirees for their sacrifices over the years.

“The choice of whether we go out on strike is up to the Big Three,” said Margaret Mock, the UAW new Secretary-Treasurer during a Town Hall meeting via zoom arranged by union’s new leadership team.

“We will go to the limit to get what we need,” Mock said, adding the union now has $825 million in its strike fund. The 40-day strike against GM in 2019 cost General Motors $10.7 billion in lost revenue and $3.7 billion in profits.

Union sharpens messaging

Unlike in 2019 when the union’s leadership was dogged by the corruption scandal, the UAW’s leadership seems determined to change the messaging around the upcoming contract negotiations.

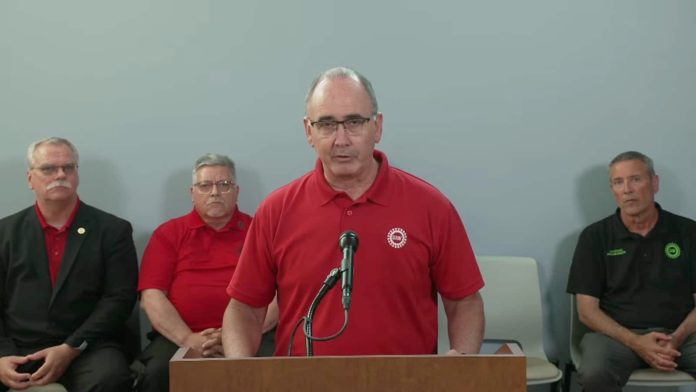

UAW President Shawn Fain said during the Town Hall that during the past decade union members have made substantial sacrifices to help make the former Big Three successful.

The three Detroit automakers have combined to make nearly a “quarter trillion dollars” in profits since 2013, Fain noted, while UAW members have seen their wages and standard of living erode.

To add some perspective to the quarter-trillion-dollar figure, the company profits are substantial enough to purchase — at current prices — every franchise in the National Hockey League, National Basketball Association and Major League Baseball and “still have $50 billion dollars left over,” Fain said.

Mike Booth, the UAW vice president who will lead negotiations with GM, said the UAW membership also works in the most profitable part of the auto industry. Detroit’s automakers sell 81% of the pickup trucks and 71% of full-size sport utility vehicles in the U.S. The average price of a vehicle built by UAW members is more than $55,000, which is substantially higher than the average price of a new vehicle reported by the U.S. Department of Commerce, according to the figures presented by union leaders.

Union demands center on gains, not concessions

During contract negotiations this summer, the union will ask for guarantees of a “secure landing place” for workers displaced by the transition to electric vehicles, which don’t need the transmissions or the internal combustion engines now built by UAW members.

At the same, the union wants to end the use temporary workers, tiered wage structures and the movement of work to limited liability corporations, which blunts union influence over wages.

Rich Boyers, the UAW vice president in charge of the negotiations with Stellantis, said one of the UAW key priorities is eliminating the eight-year grow-in period for new hires.

Booth said the union must return to the standard it set out in its successful strike against General Motors. “We need the clear standard of equal pay for equal work,” Booth said during the Town Hall. Equal pay for equal work is one of the foundations for union solidarity, he said.

“We need to change the standard,” added Fain, noting it can take 10 to 12 years for new employees to reach full pay. Other employees are kept on temporary status indefinitely, which is unfair.

Fighting downward push

At the same time, the automakers have been trying to create a new, lower wage category for workers building electric vehicles. The UAW, however, will not accept a lower wage for EV workers, Fain said. There will be no concessions in the 2023 contracts, he said.

The automakers are getting billions of dollars in federal subsidies and need to pay fair wages.

Chuck Browning, the UAW vice president responsible for the Ford negotiations, said the union will demand raises in this year’s agreements.

The union also is going to demand the restoration of cost-of-living protection, which was removed from union contract in 2009 during the auto bailout era.

The new contract also must include a boost for pensioners, according to UAW leaders. Like active members, retirees need improvements in the standard of living, said Browning.