With Scout’s 2026 production target fast approaching, Volkswagen is moving ahead on plans to set up the factories needed to produce the revived brand’s all-electric vehicles — and reports suggest that may result in two separate plants in North America.

An assembly plant would go into the U.S., according to a report by Reuters, the news service quoting VW sources saying a separate battery plant would be located somewhere in Canada.

No final decision on where to build the two facilities has been made, Automotive News separately reported, quoting a VW spokesperson. “We are still working hard to find a suitable location for our first gigafactory in North America and are in good, constructive talks,” the representative said.

Scout brand returns

Whether those new facilities would be solely dedicated to the Scout brand is another question yet to resolve, as TheDetroitBureau.com reported last week. There is a possibility the off-road-focused brand might share production operations with other Volkswagen Group brands, such as Audi.

Originally introduced by International Harvester in 1960, Scout was one of the first brands to offer sport-utility vehicles, directly competing against the Jeep line. But its parent struggled to survive, eventually reemerging as Navistar. The Scout brand was pulled from the market in 1980 — ironically, just before the real surge in demand for SUVs began.

Volkswagen purchased the rights to the Scout name last May, and announced plans to invest an initial $1 billion to re-launch the once-popular badge. After the acquisition it indicated that the first Scout concept vehicles will be revealed sometime in 2023, with production scheduled to begin sometime in 2026.

Going electric

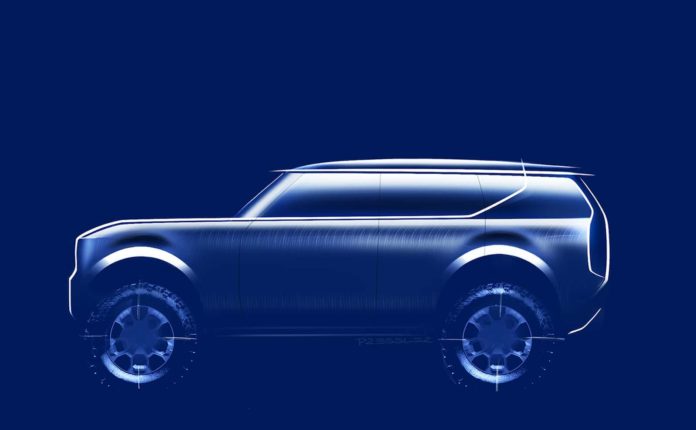

Several different vehicles are in the works, and though the final number of products hasn’t been confirmed, it will include at least one SUV and another pickup early on. Those products will be rugged enough to handle serious off-roading, according to VW. That appears to position Scout in direct competition with Ford’s Bronco sub-brand, as well as the more rugged Jeep models, including the Wrangler SUV and Gladiator pickup.

The critical difference is that Scout is intended to go all-electric from launch. Jeep has begun rolling out plug-in hybrids and is planning to add battery-electric models over the coming decade. Ford has not yet announced plans to electrify the Bronco line.

Scout will build where it sells

Producing Scout products in North America would have two advantages, VW insiders have told TheDetroitBureau.com. First, North America is expected to be by far the biggest market for its products. The other benefit would be the potential to take advantage of revised EV incentives under the strict new rules set by the federal Inflation Reduction Act.

To qualify for up to $7,500 in consumer tax credits will require Scout to use batteries produced in the NAFTA region, and use locally sourced raw materials such as cobalt, lithium and nickel.

VW appears to be focusing on Canada, VW Group CEO Oliver Blume in December calling that “one logical option” since that country has large supplies of those critical raw materials. It also would be easy to bring finished battery packs across the border to a U.S. assembly plant.

Audi option

Scout is looking to sell about 250,000 EVs annually, though it is unclear what sort of ramp up is planned. That could justify construction of a single assembly plant dedicated to the brand. But Audi chief executive Markus Duesmann left open another option.

“We do not have a factory in the U.S. yet. With the American government’s Inflation Reduction Act, building a U.S. plant for electric cars has of course become highly attractive,” Duessmann last week told the German newspaper, Frankfurter Allgemeine Sonntagszeitung.

Decisions, decisions

There is the possibility that Audi could also set up a unique plant. An alternative would see it share the hefty cost of a new assembly facility with another VW Group brand. “Both (options) are possible,” Duesmann told the German newspaper.

The Volkswagen board of directors is holding a critical series of meetings this month to solidify upcoming plans for its various brands. That is likely to result in decisions about both new EV products and production plans, Volkswagen brand CEO Markus Schaefer told TheDetroitBureau.com in January.